We have been living through an age of anxiety for years now with Trump, Brexit, Covid-19, spiralling prices and now a horrifying conflict in Europe keeping most of us on edge most the time. In such a climate of global gloom it is hard to stay positive.

But Pricewatch is nothing if not positive.

Okay, okay, Pricewatch can also be moany, tetchy, impatient and endlessly frustrated by the steady stream of stories of poor customer service and shady behaviour we get from our readers. But we try to be positive most of the time.

With that in mind we thought it would be no bad thing to mark the changing of the seasons and the recent start of spring – at least from a meteorological perspective – by looking at all the ways the brighter days of ahead might save us a few bob.

But do we really save money with the passing of the seasons? Well, according to one US study carried out in 2018, people in that part of the world spend at least 5 per cent less in the spring and summer than they do in the autumn and winter. Springtime is, by that account, the cheapest of the seasons.

While 5 per cent is pretty significant – and would all but entirely offset the current rate of inflation in Ireland – we reckon Irish people are set to make even great seasonal savings than that.

So, here are just some of the reasons to be cheerful – at least from a spending perspective – about our prospects for the months ahead.

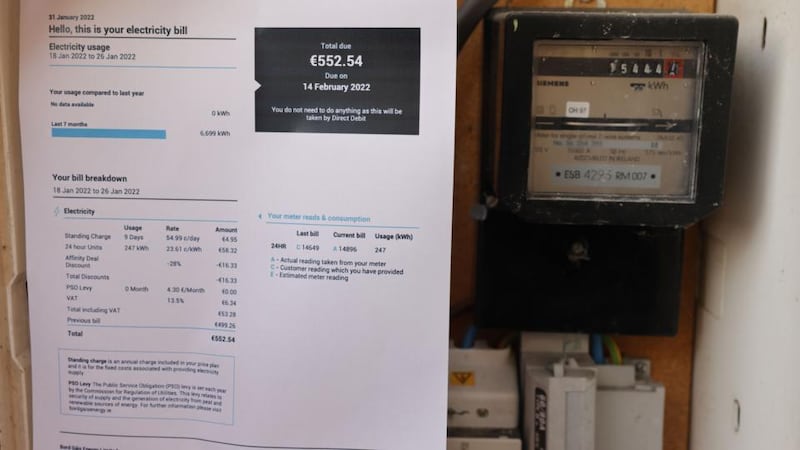

1. The spike in the cost of heating and lighting our homes in recent months has been nothing short of horrendous. Increased demand following a post-Covid economic recovery in many parts of the world as well as sudden and dramatic supply issues with gas coming from the east is to blame. The bad news is that our enduring reliance on fossil fuels and ongoing volatility on international markets means the problem is only going to get worse in the days, weeks and months ahead. But at least we should be spared the impact of some of the savage increases by our seasons in the sun – or at least our seasons without plummeting temperatures and endless grey skies.

As temperatures fall below zero has anyone anywhere ever said: 'Do you know what? I really fancy a salad for dinner.' Almost certainly not

While the price hikes rolled out by providers in recent months will see the average bill for most houses climb by in excess of €800 – with some people facing increases of in excess of €1,000 – few of those price increases will be evident in the spring and summer.

Based on today’s energy prices it costs about 90 cent to keep the lights on in your home each day over the course of the dark days of autumn and winter. By contrast it costs no more than 20 cent each day in the spring and summer – and on some of the brightest days it will cost you nothing at all as long as you go to bed before 11pm. Were we to split the seasons into dark and light, it means that as a result of the light season we are facing into, you will spend a not too shabby €127.40 less on lighting between now and the end of August. And there’s more savings on the table. If you keep your heating on for six hours each day in the dark season then your heating bill will be around €1,700 compared with absolutely nothing in the season of light. And – all going well – you should be able to stand down your horrendously expensive tumble dryer over the next six months which will save you another €150. You will also save yourself a few bob on your cooker as the likelihood of you feasting on casseroles and roasts at the height of summer is significantly demonised.

2. Speaking of food, prices up and down our supermarket aisles have been climbing for months now and the spike in inflation will see many Irish households worse off by the tune of €700 over the course of 2022 compared with 2021. The good news – if we can call it that – is that at least in the summer time we tend to spend less on food.

We can almost hearing you arching a sceptical eyebrow at that idea. But it is true. And why is that? We have our ancestors to blame – or thank. Almost as soon as those who came before us crawled out of the primordial soup they were eating more in the winter than in the summer. And they had good reason to do so. They needed to store as much fat as they could in the colder months when food was always more scarce, while in the warmer months they could afford to be more lean mean hunting machines. That is one reason we eat more in winter – although given that we have heating and access to supermarkets and the like we really don’t need to be stocking up on excess calories in the winter. Another reason is the comfort food factor. When it is cold and dark and miserable outside you want to eat things that are warm and comforting. As temperatures fall below zero has anyone anywhere ever said: “Do you know what? I really fancy a salad for dinner.” Almost certainly not.

While we are strong supporters of cycling year round, we know it can be more of a challenge in the winter months when it is cold and wet and dark and miserable

Now according to official data, the average Irish house spends about €220 a week on food. If we spend just 10 per cent less in the summer time, than in the winter time, our bills for the next six months will be €572 less than in the six months just past . . . Although all things being equal they will climb again after that because you can’t just alter tens of thousands of years of evolution in a few months.

3. Pity our poor winter wardrobe. It has to work so much harder than our summer one. For starters we need to wear far more clothes in the dead of winter than we do at the height of summer. At a minimum Pricewatch will need a coat, a hat and scarf gloves, a jumper, at least one T-shirt, maybe a thermal vest, jeans, underwear and socks and boots before we will even consider leaving the house in the colder months. Added up all of these elements will cost well in excess of 300 quid. In the summer time we might get away with cheap as chips flip flops, shorts and a T-shirt which will set us back well under €100. While the costs will differ from person to person, the bottom line is the bottom line and most people will spend at least €500 less on their summer wardrobe than they will on their winter one.

4. The great outdoors is rarely greater than in the summer time. Not only can a day at the beach or in a park or climbing a mountain be good for the heart and the mind it can also be very, very good for the wallet. For starters most of the outdoor pursuits open to us are free but there is more than that when it comes to money saving. A family of four eating mediocre food in a mid-priced restaurant will easily spend over €60. A picnic for the same four people can be sorted for less than a tenner. If you have just one picnic each month between now and the end of August instead of visiting a restaurant then you will save a not too shabby €300.

5. Days out cost less in the spring and summer than they do in the winter and they last longer too. The cost of a trip for four people to the cinema will cost about €70 when the price of tickets and popcorn and soft drinks are totted up. A trip to the Botanic Gardens or the Phoenix Park or all manner of spots along the Atlantic Way or the Ancient East or wherever you might find yourself in the country will cost virtually nothing. Two free outdoor trips each month over the course of the next six months when you might otherwise have gone indoors for some paid for fun will see your summertime spending drop by €840.

6. While we are strong supporters of cycling year round, we know it can be more of a challenge in the winter months when it is cold and wet and dark and miserable. It's a much more attractive option in the spring and summer. And it can be a big money-saving option. How big? Well, if you commute to work and travel just 8km each way and you usually drive, then you will travel 3,760km to and from work over the course of a year. If your car has a fuel consumption rate of 9.5 litres per 100km you will use about 370 litres of fuel on that commute. If a litre of fuel costs €1.85, the cost of your car commute over the six months between now and the end of August will come in at €342.50. Assuming you have a bike at your disposal, the cost of cycling the same distance over the same period of time will be zero.

7. And speaking of exercise, we are big fans of gyms – or at least we are a big fan of our gym, particularly on dark cold mornings when going for a run in the park is as appealing as sitting in a bucket of fish guts for an hour. But as the grand stretches in the evenings become ever grander, there is definitely a case for taking your workouts into the outside world. If you were in a position to suspend your gym membership for the spring and summer you could handily knock as much as €300 off your annual spending and maybe even enjoy your workouts that little bit more. It might not suit everyone but it would definitely suit some people. Following this course has the added bonus of stripping away the guilt factor you might feel after paying for a gym membership you only rarely use.

8. GPs surgeries are always busier in the autumn and winter than they are in the spring and summer – and that was the case long before Covid came along and made life so much harder for all of us. If it costs €60 to visit your GP and you go three times in the dark season and just once in the light season, then already you are €120 better off. Not having to spend any money on antibiotics, cough syrups and paracetamol might see your savings climb that little bit higher.

9. Ho, ho ho noooo it's Christmas. Well, it isn't Christmas obviously. In fact there are 292 sleeps until Christmas. So why are we mentioning it? Because the season to be jolly is in the middle of winter and has done since pagan times when – in the absence of the Netflix and the like – our ancestors were desperate for something to alleviate the eternal gloom. Fast forward to now when the season is less about hedonistic dancing around open fires and slaughtering the fattest calf you can lay your hands on and more about spending money on presents and food and booze. All told few Irish households will have much change out of a grand by the time all the crackers are pulled and the champagne corks popped.

10. But what about summer holidays we can hear you ask. Isn't that a summertime cost that we don't have in the winter? It is a fair point. But here's the thing. January is by far the busiest time for summer holiday bookings followed by February. That means that many people will have already paid for their summer jollys so when the time comes to take them, there will be no additional costs to factor in.

This brings us back to the good news at a time where almost everything we see, hear and read is so depressing. We have totted up all the cost that you might reasonably be expected to face in the six months between September and February that you don’t have to pay for between March and August and reckon that many people will be able to get through the spring and summer for almost nine grand less than it costs them to get through the autumn and winter. While savings on this scale are obviously a cause for celebration they do come with the knowledge that – all going well – higher spending will be coming down the tracks later in the year.