Stock markets edged downwards on Friday after US president Donald Trump's threat to impose an extra $100 billion in tariffs on China exacerbated fears of a more serious trade dispute, while the dollar paused ahead of crucial US payrolls data.

European shares followed their Asian counterparts into the red but the falls were limited, and the broader ups and downs for markets this week suggest investors are not yet convinced the row will escalate into a full-blown trade war that threatens global economic growth.

European and US government bond yields fell and prices rose as investors sought the safety of government debt, but the moves were moderate. In stock markets, Britain’s FTSE 100 dropped 0.3 per cent while the German Dax was down 0.6 per cent and France’s CAC 40 0.4 per cent.

DUBLIN

The Iseq closed down 40 points at 6,632, roughly in line with other European bourses. Financial stocks suffered most. Permanent TSB was down 3.5 per cent at €1.92. One trader said the stock had fared better than rivals in recent weeks but nagging doubts about its stock of non-performing loans persisted. Rival Bank of Ireland, meanwhile, was down by 1.7 per cent at €7.15.

Irish engineering group Mincon closed up 1.6 per cent at €1.25 after positive signals about future growth from the group's chairman.

Independent News & Media (INM) was down a further 2.5 per cent at 9 cent as the data breach controversy rumbles on.

Packaging giant Smurfit Kappa, which is resisting a takeover by US rival International Paper, finished up 0.3 per cent at €35.08.

Ryanair traded marginally down at €16.40 in the wake of less than spectacular figures from rival EasyJet in the UK. Building materials group CRH was down nearly 1 per cent at €27.60 amid warnings from shareholder advisory group ISS over executive pay.

LONDON

Trade war jitters sent the FTSE 100 down 0.2 per cent or 15.86 points to 7,183.64 points. Royal Mail Group shares rose 4p to 556.6p despite being fined £12,000 for sending more than 300,000 nuisance emails. AO World shares surged 15p to 129.8p as the online retail said full-year revenues would come in 14 per cent higher at £796 million, slightly above the mid-point of market expectations despite a tough market and fewer promotions.

The biggest risers on the FTSE 100 were Micro Focus International up 34.5p at 1,128.5p, United Utilities Group up 16.4p at 724.8p, WPP up 24p at 1,162.5p, and DCC up 125p at 6,645p. The biggest fallers on the FTSE 100 were Rio Tinto down 85.5p at 3,560p, Glencore down 7.6p at 351.15p, Marks & Spencer Group down 5p at 269p, and Burberry Group down 28p at 1,676.5p.

EUROPE

The pan-European Stoxx 600 sank 0.4 per cent. Europe's car stocks led the losses on Friday, down almost 1.7 per cent amid heightened trade tensions. Schaeffler and Hella were among the worst sectoral performers, down 1.33 and 1.57 percent respectively.

Telecom Italia surged to the top of the European benchmark following report that the Italian state lender CDP intends to buy a stake of up to 5 per cent in the firm. Shares of Telecom Italia shot up by almost 7 per cent.

NEW YORK

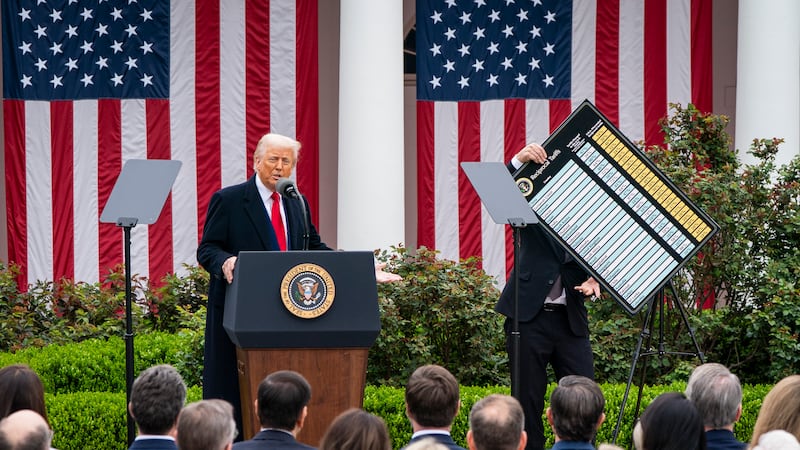

US stocks tumbled on Friday on fears of an escalating trade war between the United States and China after President Donald Trump threatened to slap $100 billion more in tariffs and Beijing warned it would fight back "at any cost"." In light of China's "unfair retaliation" against earlier US trade actions, Mr Trump upped the ante by ordering US officials to identify extra tariffs, escalating a high stakes tit-for-tat confrontation. China commerce ministry spokesman Gao Feng said the two countries had not recently held any negotiations, which are impossible under current conditions.

Boeing, the single largest US exporter to China, fell 2.5 per cent. Caterpillar declined 1.3 per cent and Deere dropped about 2 per cent. Chipmakers, which as a group rely on China for about a quarter of their revenue, also declined. The Philadelphia semiconductor index fell 0.54 per cent.

Tesla shares plunged 22 per cent in March and closed at $252.48 on April 2nd, the lowest in more than a year. They climbed 21 per cent on Thursday, after the company stood by its next Model 3 production target and said an equity or debt raise would not be required this year. The stock traded down 1 per cent $302.24 in New York on Friday.

Non-farm payrolls increased by 103,000 last month, the US Labor Department said, the fewest in six months and lower than economists' forecast of 193,000 jobs. – Additional reporting by Reuters and Bloomberg