Engineering companies, auto names and chip makers helped to propel global stock indexes to modest gains on Thursday, outweighing worries that the Federal Reserve will keep raising interest rates for longer after data highlighted a tight US labour market.

Among other things, investors digested minutes from the Fed’s last policy meeting.

They revealed that almost all participants agreed it was appropriate to raise rates by 25 basis points earlier this month, even though “a few” said they would have preferred a 50-point increase or could have been persuaded to support one.

Dublin

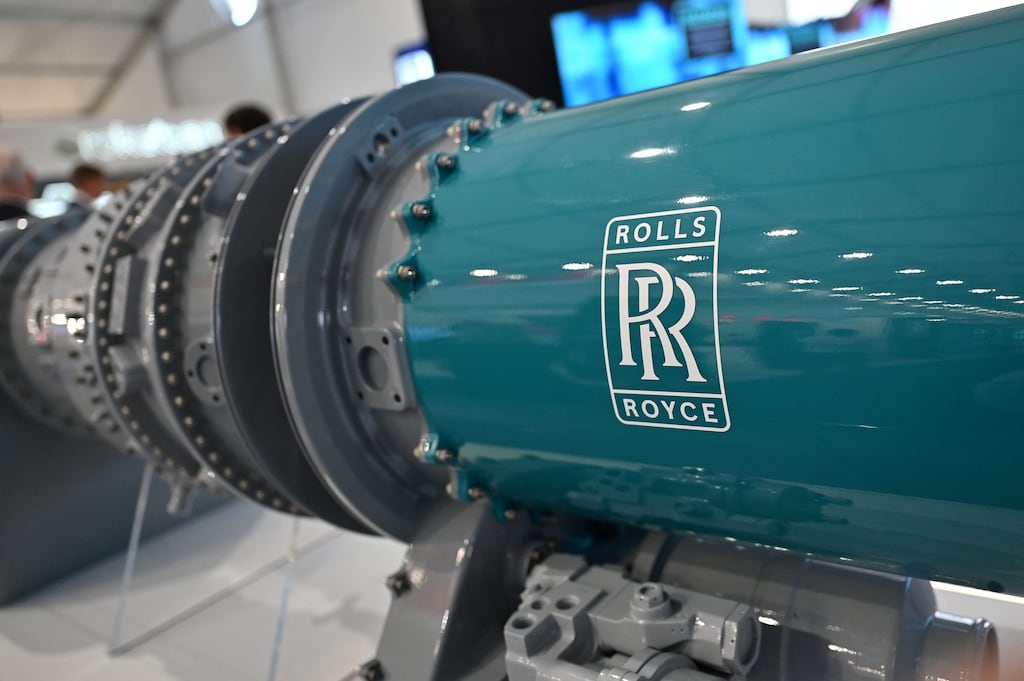

The Iseq index finished flat on the day, off by less than 0.1 per cent after Wednesday’s 0.9 per cent drop. Traders in Dublin said two big moves in opposite directions effectively cancelled each other out on Thursday, with Ryanair “well better” through the session. Shares in the airline surged almost 2.7 per cent to €14.86, a positive read-through from aviation engine-maker Rolls-Royce’s improved outlook for global air travel this year.

RM Block

Moving in the other direction was Smurfit Kappa, which gave back 1.8 per cent to finish the session at €34.72. The move was fuelled by the Irish box maker’s UK peer Mondi, which published positive results on Thursday while also warning of a softer outlook for the rest of the year amid weakening demand and pricing.

It was a mixed session for the Irish banks, meanwhile, with Bank of Ireland down 1.9 per cent to €9.65 per share, while Permanent TSB added 2.8 per cent to close the session at €2.58. AIB finished at €3.824, down almost 0.5 per cent.

London

The blue-chip FTSE 100 shed 0.2 per cent despite strong upward pressure from Rolls-Royce. Shares in the engineering giant soared almost 23 per cent on Thursday after it reported a 57 per cent increase in underlying profits to £652 million, £505 million generated in cash, and revenues up 16 per cent to £12.7 billion in 2022 – well above analysts’ expectations.

Aer Lingus owner IAG, meanwhile, jumped more than 4 per cent in advance of its full-year earnings release. Advertising giant WPP added nearly 3.9 per cent after forecasting better-than-expected organic growth of 3-5 per cent for 2023.

Moving backwards, miners Anglo American, Antofagasta and Rio Tinto shed 2.6 per cent, 2.7 per cent and 2.4 per cent respectively after disappointing earnings in recent days. Anglo American also reported on Thursday that it had taken a $1.7 billion impairment on the North Yorkshire fertiliser project it saved from collapse three years ago.

Europe

European stocks eked out modest gains on Thursday with the pan-European Stoxx 600 up by just under 0.1 per cent while the blue-chip Stoxx 50 index added 0.4 per cent.

In Paris, the French Cac 40 index was up 0.4 per cent while the German Dax index was 0.6 per cent higher on the session.

Auto makers continued their upward march on Thursday, with Stellantis up more than 4 per cent, leading the charge. The Jeep and Peugeot maker published results on Wednesday showing that group net profits rose by a quarter last year to €16.8 billion amid soaring demand and supply chain bottlenecks.

On Thursday, BMW, Daimler and Volkswagen all benefited, adding 0.4-1.2 per cent by closing bell.

Energy stocks were down on lower benchmark European gas and oil prices. Italian energy multinational Eni gave back more than 5 per cent while Spanish utility Iberdrola gave back almost 0.4 per cent.

New York

US stock indexes climbed on Thursday as a strong sales forecast from Nvidia boosted chip makers and outweighed worries that the Federal Reserve would keep raising interest rates for longer after data highlighted a tight labour market.

Nvidia surged 14.3 per cent to a more than 10-month high after the chip designer forecast quarterly sales above estimates and reported a surge in the use of its chips to power artificial intelligence services such as chatbots.

Other chipmakers such as Broadcom, Qualcomm, Intel and Advanced Micro Devices rose 0.3-3.8 per cent. The Philadelphia SE Semiconductor index jumped 2.7 per cent.

Nine of the 11 big S&P 500 sectors gained. But communication services slid 0.7 per cent, hurt by a 4.6 per cent drop in Netflix on reports that the entertainment services firm was cutting subscription prices in 30 countries.

The S&P 500 closed lower for a fourth session on Wednesday as minutes from the Fed’s meeting showed nearly all policymakers backed rate hikes but agreed the shift to smaller-sized hikes would let them calibrate better with incoming data.