Comparing living standards across different countries is not easy. There are a range of adjustments needed to the figures to take account of the different level of prices for a start. Beyond that it can get even more complicated. How, for example, do you value the services provided by, say, the Irish health service versus those in other countries? Or account for different spending preferences? In a new paper, Prof John FitzGerald looks at how best to compare how we are doing in relation to the UK and EU.

1. Why the normal measure does not work

Living standards are typically compared by looking at the level of Gross Domestic Product (GDP) of a country and dividing it by the size of the population. When this GDP per head figure is then adjusted for varying price levels in different countries, it is then typically used to compare living standards.

The problem for Ireland is that we know the level of GDP is hugely inflated by the accounting policies of multinationals here, so the GDP per head figures give a misleadingly high estimate of Irish standard of living, showing it to be one of the highest in the EU and ahead of countries like Germany and France. So for Ireland, this simply does not work.

2. Making an adjustment

In 2017, the Central Statistics Office (CSO) developed Gross National Income Star (GNI*), a measure designed to filter out a lot of the noise from multinational accounting and other distorting factors. GDP is 2021 was €426 billion while GNI* was €323 billion, a huge gap.

RM Block

The GNI* growth rate between 2013 and 2021 has averaged 4.1 per cent, which looks to give a better indicator of the economy than the inflated 9.5 per cent average from the traditional measure.

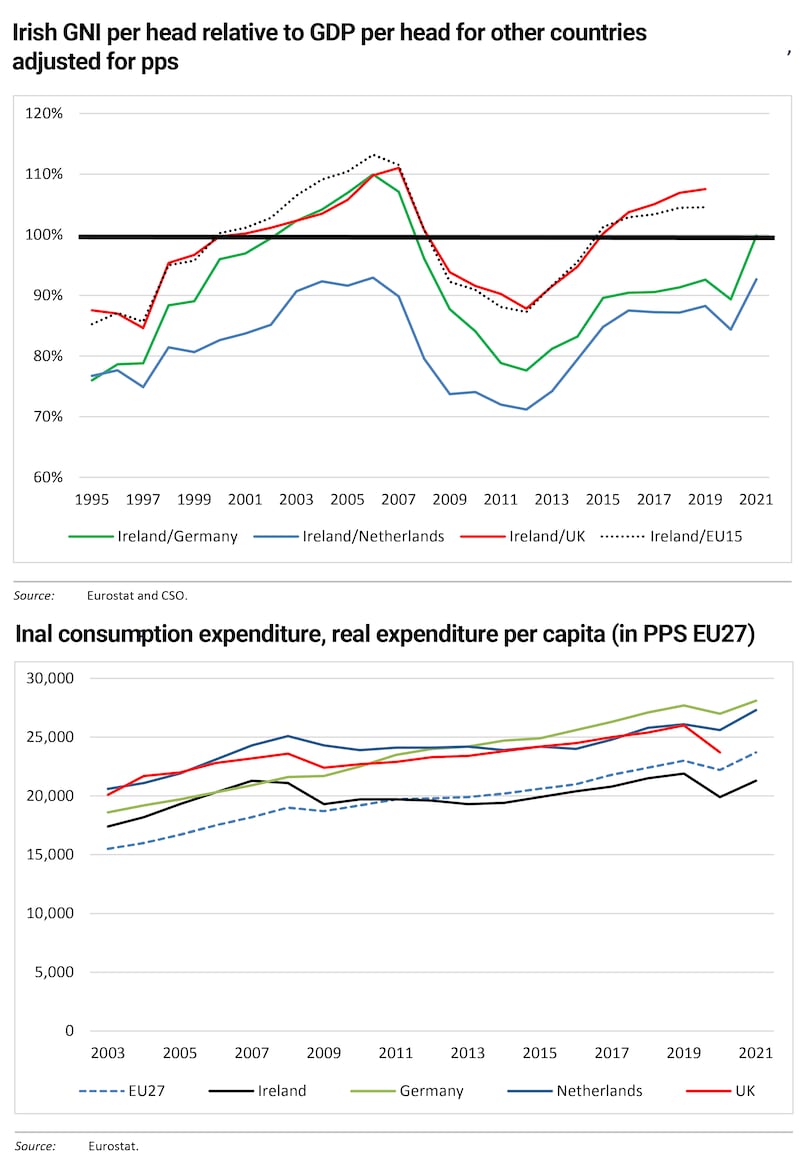

But what about living standards? Here the conclusions are interesting. Looking at GNI* per head, adjusted for price differences, we see that in the early 2000s Irish living standards were approaching those of Germany, the UK and the EU15 and, by 2007, had exceeded them by 10 per cent (by which stage we now know a huge unsustainable bubble had inflated).

But Ireland was hit particularly hard by the crash and, by 2011, living standards here were 10 per cent below the UK average and 20 per cent below Germany. As the economy recovered, the data suggest that, by 2019, Irish living standards were once again above the UK (by 8 per cent) and by 2021 it had reached German levels, though still lagging the Netherlands.

This is clearly more realistic than the GDP measure and the trend does reflect the boom-to-bust-to-strong-growth cycle we have seen since the start of the 2000s.

One interesting factor is that breaking down GNI* into its various components suggests that actual spending on goods and services – consumption – is significantly below the UK, Germany and the Netherlands while Ireland scores better on investment and significantly better on a strong balance of payments.

These are relevant because both investment and a strong trade performance can underpin further growth. But consumption is what reflects living standards right now.

The figures suggest, in part, that relatively lower levels of spending here are due in part to higher savings by Irish households, which rocketed in particular during Covid. Final national accounts for 2022, due this month, may shed some light here and analysts will watch to see whether there is an increase in the estimate of consumer spending.

3. Looking at consumption

Another way to look at living standards is to purely look at consumption of goods and services. Here Ireland generally scores lower in, for example, annual actual individual consumption figures produced by Eurostat, the EU statistics arm, each year. Using this approach, the figures suggest that living standards here are below the EU average and also those of Britain, Germany and the Netherlands. A key reason for this is that prices facing consumers in Ireland are judged by Eurostat to be particularly high – the highest in the EU for a basket of typical goods according to recent figures. And high prices mean that consumers get less for their money than elsewhere.

These figures have been questioned by some economists, including UCC’s Seamus Coffey, who raise issues about their comparability with data elsewhere and point, in particular, to anomalies in areas like the treatment of housing.

Just as the GDP figures “feel” wrong, the relative lack of progress in recent years shown by purely looking at the consumption figures jars, given strong economic growth and low unemployment. In a separate paper two other ESRI economists, Adele Bergin and Seamus McGuinness, suggest making allowances for a higher savings rate in Ireland and thus using disposable income as a measure to compare across countries. This would position Ireland above the EU average, but below Germany and the Netherlands in 2021.

4. Reaching a conclusion

As ever with statistics, it is vital to know what you are looking at. FitzGerald concludes that Ireland’s high savings level is relevant – as reflected in the surplus on the current account of the balance of payments. This should support future living standards as this cash is invested or spent.

However he says that the consumption per head measure is also relevant and gives a snapshot of people’s living standards right now. This leaves us below a number of EU neighbours, partly due to the high level of savings of Irish households.

Deploying these savings – crucially via investment – will be a big issue in supporting living standards in the years ahead, while many better-off households also have significant financial buffers which can support consumption in the years ahead.