It is depressing but unsurprising to learn that customer service in Ireland is getting worse, at least that’s according to an annual assessment of the state we’re in published earlier this month.

Since 2015, a customer experience report has landed on the Pricewatch desk in the middle of October charting how the 150 companies and service providers most frequently mentioned by consumers to the team of researchers conducting the survey are doing.

The answer this year is badly.

This customer experience (CX) report by Amárach Research suggests that after two years of things looking up, our overall customer experience score fell by just under 2 per cent compared to last year with 42 per cent of the companies in the top 150 seeing their customer experience scores decline as too many organisations labour under the misapprehension that while decent service is nice to have it is by no means essential.

RM Block

Too often actually caring about people has “become a box-ticking exercise”.

The author of the report Michael Killeen says the drop in customer experience ratings indicates that a post-pandemic bounce which saw some companies notably improving the service they offered “has now truly dissolved”.

He points the finger at the cost-of-living crisis which has caused “a significant wobble” and the “disillusion” among too many companies that creating digital channels for communications should be done mainly to save money rather than offer customers more and better options.

The top 30

The bottom 30

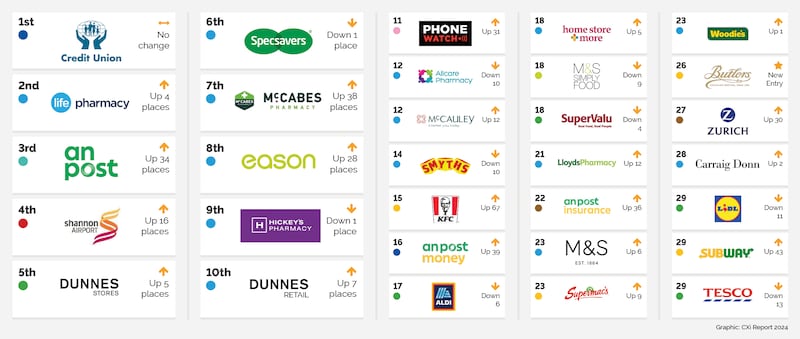

The report ranks brands based on consumer experiences and while its 10th edition recorded strong performances by supermarkets and pharmacies, the standout performer was the credit union movement.

It has topped the survey every single year – an unheard of achievement across comparable league tables, says Killeen, adding that the credit unions’ formula for success is simple – “members are always put first”.

Pharmacies make up three of the top 10 with Life Pharmacy in second, McCabe’s seventh and Hickey’s ninth. An Post’s mail and parcels division is third while Shannon Airport landed in the top 10 for the first time, finishing in fourth position. The Dunnes Stores supermarket division claimed fifth and its broader retail section came 10th. Specsavers in sixth and Eason in eighth completed the top 10.

KFC recorded the biggest jump, up 67 places to 15th while Burger King was the second biggest jumper, moving up 50 places to 53rd.

By contrast, the biggest fallers were Power City and Aer Lingus with the former plummeting from third to 95th and the latter dropping from 41st to 123rd, still 15 places ahead of Ryanair which was in 138th place.

Eir and RTÉ are still feeling the wrath of customers along with brands such as Fastway couriers and Uisce Éireann and although Ticketmaster climbed four places to 143rd place, it remains rooted to the bottom end of the table alongside last-placed Facebook, Instagram in 147th and Google in 144th.

The study makes it clear that while empowered, knowledgeable and empathetic staff are the key to a better customer experience there is still too much focus on the bottom line and a “dire need to replace product and process training with human touch and empathy training to help build deeper human relationships”.

We have been saying the same thing for years now.

There are exceptions particularly when it come to the highly competitive sectors such as retail, supermarkets, restaurants and travel and it is in these arenas where customer experience “is being seen and used as a stand out differentiator,” the report says.

Companies who are helping with the cost-of-living crisis performed stronger than those that didn’t

— Report

It notes that while trust has always been critical to good customer experience in this year’s survey only seven organisations out of 150 achieved a score of eight or higher, which is how it measures customer experience excellence.

The eight companies, it says “have worked hard to build their trust over many years because they know it’s not a given and is built slowly through every interaction. They also know it can be lost very quickly and once gone, is extremely difficult and costly to repair,” Killeen says.

The rankings, the report continues, “give us a stark reminder of the importance of being transparent and honest with customers as we see organisations who have not behaved like this slide down the league table, in particular, large social media sites”.

A lot of the time a good experience comes down to the staff on the front lines with customer loyalty and trust “highly correlated” to the impact that employees have and it is “the human interactions that create highest levels of both”.

It says that while recruiting, nurturing and empowering the right people, particularly those who deal with customers directly, is challenging at a time of full employment and higher staff turnover, companies would do well to make sure customer experience is part of both induction and ongoing training programmes’.

The study is nothing if not realistic and recognises that while customer care is key, cold hard cash is important too and while people are happy – or at least willing – to pay for better care the value they get needs to be tangible.

“Companies who are helping with the cost-of-living crisis performed stronger than those that didn’t,” the report says.

There are other nuggets to be mined in the study. For example, customers who have been with an organisation longer tend to score their experiences lower than newer customers “reinforcing the belief that as time goes by, customers expect the value they get from a long-term relationship with an organisation to increase. This is tied in closely with loyalty so demonstrating recognition and not taking long-term customers for granted remains a key” it says.

The authors say the decline in Ireland’s overall CX score is concerning, as is the widening gap between the best and worst performers. Gerard O’Neill, who has been compiling the survey results on behalf of Amarách over the past 10 years, says that while scores are now generally higher than before the pandemic, “they are still not back at the levels we recorded in 2017 and we are also seeing a greater degree of ‘CX polarisation’ between the best and worst providers, suggesting some brands are falling seriously behind in their CX ambitions.”

He says that this sometimes this happens “when companies move too fast to digitalisation, often driven by the need to save costs rather than customer considerations. That is something we are seeing again in the current market, driven by the cost-of-living crisis.

“It can also happen when companies fail to retain experienced customer facing staff – a real issue at a time of full employment – and then compound the problem by failing to put proper CX training systems in place for new staff. Or when different departments in a company are operating in silos and no one is seeing the bigger CX picture. CX remains relatively simple to understand but is challenging to deliver because it requires full leadership buy-in and cross-department co-operation. For too many Irish companies one or both of those are missing”, O’Neill concludes.

The evolution of humanisation: Ten years of customer experience feedback

With the benefit of 10 years of research, the authors of the report also assessed how the strategic practice of customer experience has changed and evolved (or regressed) since 2015 using several distinct themes.

In the first iteration of the report, researchers looked at humanising interactions and suggested that our relatively modest population presented unique challenges and opportunities. “Being greeted by name and showing a genuine interest in your family is a normal occurrence in rural and local urban communities. Ireland should leverage human interactions wherever possible. Machines don’t generally make emotional connections. People do and it’s an area in which Irish people the world over excel. Ireland should strive to be world leaders in humanising [customer experience] because our demographics allow for it.”

Fast forward to now and the authors say that first report was “right then about Ireland’s unique capabilities and opportunities, and we are still right today nearly 10 years later.

“The fact that Ireland’s credit unions are consistently among the highest-scoring brands in the world is testimony to the uniquely Irish sense of what we want to experience as customers. Not just humanising but belonging.”

Looking ahead, faced with the challenge of artificial intelligence AI and the growing pushback against “invasive” social media and digital technologies, the latest report says the case for humanising customer experience will only grow stronger over the rest of the decade.

The second theme identified a decade ago was embracing digital platforms to accelerate customer experience.

The first report noted that customer experience gains were possible using “streamlined services and personalisation” including acknowledging a customer’s age and demographic, location, recent transactions, what they like and dislike and “when they want to hear from you and when do they not want to hear from you.”

Recession era cost-cutting is still the norm in the production, fulfilment and customer service areas of Irish business. This causes a rift between the ‘story’ and the ‘reality’

Now the authors wonder if the first report went too far. “Back in 2015, digitalisation promised to free up resources from regular, repetitive, low value-added activities to focus on added value, more personalised and relevant experiences. But things didn’t work out as well as they might have,” it says.

“Instead of freeing up resources for better customer experience, digitalisation was seen as a way of reducing resources dedicated to [it]. And the customer noticed. Yet, as we enter the second half of the 2020s, the promise of digital improvements to customer experience hasn’t completely receded.

“One thing brands are learning better – post-GDPR and the imminent ‘death of the cookie’ – is that sometimes customers want to be left alone. Perhaps the biggest challenge for digital customer experience in future will be to know just that: when the customer has had enough and doesn’t want to hear from you.”

The third theme was managing the expectations gap. The first report suggested that “in general, it seems that Irish companies are bad at meeting their customers’ expectations. As the economic upturn starts to take hold, money is being allocated to marketing and sales activities.

“However, the same cannot be said of the operational sides of businesses. Recession era cost-cutting is still the norm in the production, fulfilment and customer service areas of Irish business. This causes a rift between the ‘story’ and the ‘reality’. This first problem is amplified by the fact that very often marketing and operations are not talking. In order to align what you say to what you do there must be constant communication between these teams.”

One of the problems the authors have observed over the past 10 years is that the greater part of customer experience activity in firms is “pro-cyclical”. That means that when times are good and companies are expanding, they throw lots of resources at customer experience, often far more than what is necessary to deliver good experiences and keep customers loyal. But then when times are bad, and companies should be spending more on loyalty and customer experience they cut budgets “shrinking resources that should be dedicated to customer experience, when it would be wiser to expand them.”

Top tier CX: Standout customer service shortlist

This year, An Post and Eason returned to the top tier, while Shannon Airport, McCabes Phamacy and Dunnes Retail are new entrants. Specsavers, Life Pharmacy, Hickey’s Pharmacy and Dunnes Stores supermarkets maintain their positions in the top 10 from last year while the Irish credit union movement is the only brand to have maintained a presence since the survey started in 2015.

This is what the report says about the top five.

Credit unions: Credit unions have topped the league table for best customer experience in Ireland, breaking every league table record around the world. Their position remains unchanged because their approach to members remains unchanged – members are always put first. It’s that simple.

The credit union is both a reassuring and comforting presence within hundreds of communities across Ireland as well as being available online or on the phone. Credit union staff still genuinely get to know their members. They truly listen so as to understand their members’ life-stage needs and customise solutions especially for them. While digital bank options are available within the Irish League of Credit Unions, if you want to ring or drop into them, you’ll find a person there to talk to at over 400 locations. This is what makes credit unions unique and enables them to build such strong customer affinity.

Life Pharmacy: Life Pharmacy remains committed to deep community relationships on a consistent basis. Their online health-service innovations and home deliveries are incredibly convenient and frictionless. Staff are committed to dealing with customers in a human way. Their ability to connect with consumers be they healthy or sick has always been a differentiator for their business.

An Post: Staff at An Post continuously strive to manage and exceed Irish customer expectations. They are 100 per cent committed to delivering an excellent service to each household and business every day across Ireland. An Post continue to expand its investment in electric vehicles and reduce carbon emissions. It has also modernised its offerings, from digital stamps to flexible delivery and returns options. More recently it has shown ways in which it is easy to be part of the circular economy with its sending and returns services. It is the An Post Mails and Parcels team that makes a real difference for every Irish citizen covering each corner of the country.

Shannon Airport: Simplifying and making the travel experience easy and enjoyable for passengers is central to Shannon Airport’s mission. What truly distinguishes it is its relentless pursuit of new ways to elevate the customer experience. This commitment is woven into its DNA and is backed by continuous innovations such as the world’s first duty-free shop, Europe’s first airport autism sensory room, and recognition as one of only two airports globally awarded “age friendly” status by the World Health Organisation.

Its long-term vision is to make Shannon Airport the first choice for Irish travellers nationwide. To achieve this, staff don’t just assume they know what their customers need – they ask them. Through a weekly research programme that engages 500 passengers, they gather valuable insights that spark fresh innovations. This ongoing cycle of feedback, benchmarking, and improvement keeps Shannon Airport evolving to meet the changing needs of their passengers.

Dunnes Stores: It has retained its top ten position in our league table and continues to elevate customer experience, reinforcing its reputation as a trusted Irish brand. With its focus on delivering top-quality products and unbeatable value, it has expanded its home delivery and Click & Collect services nationwide, offering more convenience and flexibility than ever before.