It was the referendum that wasn’t; but was it confusion or something else that saw the electorate reject a measure to recognise “durable relationships” in the Constitution?

Either way, it’s worth considering just what the differences are between a couple who are married and those who are not, as it now stands. What are the rights, both legal and financial, of married couples? Well, if it’s good enough for Rupert Murdoch to embark upon it for the fifth time, there must be some benefits.

Next week, we will look at the position of those in so-called “durable” relationships – or those who have opted not to get married.

Remember, while you can no longer enter into a civil partnership since the introduction of same-sex marriage in 2015, those who entered into such an agreement before this date enjoy the same benefits as being married, and therefore references to married in this article also apply to those in civil partnerships.

RM Block

Income tax

It is often thought that once you get married, immediately after the whirl of the wedding and honeymoon, you’ll start to enjoy significant tax benefits – which may help defray all those wedding-related costs.

But, while this may be true, it isn’t always so.

Getting jointly assessed as a married couple is beneficial only for those in a certain income category. If, for example, you are in a married couple where one member earns less than €42,000, or the standard rate band, then there can be merit in being jointly assessed, as one of the married partners can use up the other’s standard rate allowance.

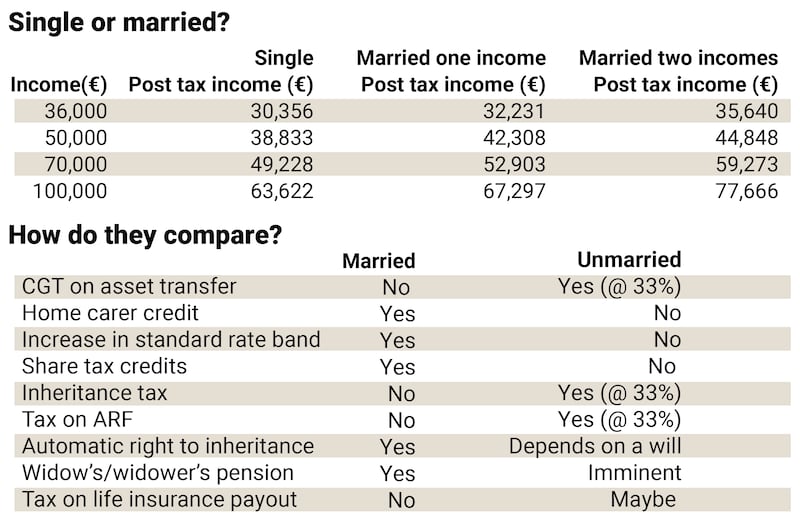

Consider our table, which shows a married couple, both earning €35,000 each, or €70,000 combined.

This couple will get to keep €59,273 of their income – or €10,045 more than a single person earning €70,000 would. And if only one partner works (and earns €70,000), again being jointly assessed can lead to tax savings, as they will get to keep €3,675 more than the single/unmarried earner.

Over the course of 30 years, this “marriage differential” translates into a significant €110,000 or so. This is because, in addition to sharing tax credits, a married couple with just one earner will pay 20 per cent tax on up to €51,000 of their income, compared with just €42,000 for a single person.

However, the benefits of being married are pitched at middle-income earners. If you have two full-time workers, both earning €42,000 a year or more, then it’s a different story.

“After the point that both persons are earning €42,000 each, there is no benefit,” says Mairead Harbron, a partner with PwC Private.

A single person earning €100,000, for example, will get to keep €63,622 of that income after tax; and a married person earning €100,000, with a spouse earning a similar amount, will also have after-tax income of €63,622.

Couples in that position may opt to remain separately assessed from an income tax perspective.

But even for these couples, being married can pay dividends at some point. Work patterns can change over the course of a marriage with the possibility of reduced working hours leading to a reduced income, which may make being jointly assessed, whereby tax is applied on your combined income, preferable.

For Harbron, the advantage of being jointly assessed – even if you don’t get a lower income tax bill because of it – is that only one tax return will need to be filed, instead of one per spouse.

If you are not married, however, you cannot benefit today from being jointly assessed - and you cannot benefit at some future point.

If you are married and will benefit from being jointly assessed, you must notify Revenue by March 31st in the year in which you want it to apply.

Home Carer Tax Credit

Another tax benefit – though again one that really only applies to those on certain incomes – is the Home Carer credit. This is aimed at people – typically women – who take time out of the workforce to care for a dependent relative, typically children up to the age of 18.

The amount of this credit has been increasing in recent years, to €1,800 in 2024. Back in 2015, for example, it was worth just €810.

It doesn’t preclude the home carer from earning any income; they can earn up to €7,200 a year and claim the credit in full. After this, the credit is scaled back and disappears entirely once the carer’s annual earned income hits €10,800.

Latest figures show that only about 75,000 taxpayers benefited from this relief in 2021, even though it is estimated that far more people should be entitled to it. The average claim was for €1,409.

Whether or not you should avail of this claim will depend on how much the working partner earns, as you can’t claim the increase in the standard-rate band and the tax credit at the same time. In practice, Revenue will typically grant the more beneficial treatment.

Other benefits

There are other tax benefits which, though they may only come up infrequently, can confer sizeable advantage.

“The really significant advantage outside of income tax is the capital gains tax (CGT) and capital acquisitions tax (CAT) spousal exemptions,” says Harbron, adding that they are “particularly important exemptions”.

Spouses are not liable to CGT, which is charged at 33 per cent, when assets are transferred between them. In addition, no stamp duty is paid on transfers of shares between spouses.

Losses can also be shared between spouses, which means that if one spouse is carrying a loss on an investment, they can use this to offset a gain made by the other spouse on the sale of an asset.

In practical terms this will mean no tax on death for the transfer of family assets, and includes payments such as life insurance policies, which may pay out in the event of the death of one of the partners.

Pensions

Pensions is another area where a married couple may do better than those who are not legally wed.

If your occupational pension scheme offers spousal benefit in the event of your death, for example, the surviving spouse will be entitled to this. And if the person who died had an approved retirement fund (ARF), this will transfer tax-free to a spouse.

And what about welfare benefits? Well, if one party dies, and the surviving person doesn’t have enough PRSI contributions in their own right, they can be entitled to a widow’s or widower’s pension on the basis of their dead spouse’s PRSI record. The widow’s pension is paid out a rate of €237.50 for those under the age of 66, and €277.30 for those over – the same as the full rate State pension. There is also an increase of €46 a week where there are children under the age of 12, and €54 for those aged 12 and over.

You will also be entitled to the Widowed or Surviving Civil Partner Grant (€8,000), a one-off payment for married couples with dependent children.

Death

One of the biggest advantages to being married is the ability to pass on assets after your death in a tax-efficient manner.

If you’re married, you can transfer assets to your spouse free of tax without any limit, thus saving capital acquisitions tax – inheritance tax – which is charged at a rate of 33 per cent.

Not only that, but your rights to inherit are also better protected under law. Under the Succession Act 1965, a spouse has a legal right to a minimum of one-third of your estate if there are children – no matter what your will might say – or one half if there are no children.

This doesn’t mean that you don’t need a will, however. “The main thing to think about is that if you have no will, then the Succession Act determines who gets what,” says Harbron. This can be awkward even for a married couple as, if there are children, these will have a right to get a third of your assets – even if you wanted your spouse to inherit everything.

“This is why it’s important to have even a basic will in place, so that your intentions are met,” she adds.

There is one benefit to not being married – if you break up, you won’t have to go through the financial and emotional ordeal of getting separated or divorced. On the other hand, marriage may ensure a fairer distribution of assets and offers greater protection than cohabiting.

- Sign up for Business push alerts and have the best news, analysis and comment delivered directly to your phone

- Find The Irish Times on WhatsApp and stay up to date

- Our Inside Business podcast is published weekly – Find the latest episode here