Oh to live in Belgium; no, not for the chocolates, or beer, but rather for its savings rates. Yes, in the same week that the Irish State Savings scheme increased its rates – to a top annual rate of 2 per cent on the 10-year bond – the Belgian government launched its own special offer.

It sold a record €22 billion of bonds to households in Europe’s largest ever retail debt offering. In an effort to “stimulate competition” in the savings market – and reduce its sovereign funding costs – it offered a one-year bond at a rate of 3.3 per cent to retail savers, with a lower than usual tax rate of 15 per cent.

Just like in Ireland, Belgian banks have been slow to hike up their rates, so the Belgian government took action itself.

“Savers are giving a signal to their banks to say ‘We are expecting a higher return than the one that you are offering nowadays on your savings accounts. We ask at least the same respect that you have for your shareholders’,” Belgian finance minister Vincent Van Peteghem told Reuters of the bond issue.

RM Block

It seems the 3.3 per cent rate was a no-brainer for many, as more than 600,000 Belgian households signed up for the offer.

[ Irish banks lag behind wider euro zone in passing rate hikes to on-demand saversOpens in new window ]

In Ireland, there has been no such move to drum up competition; yes, the National Treasury Management Agency (NTMA) did recently announce it would increase rates offered through State Savings but these are still below some of the market rates available. And it still pays institutional investors better rates than retail savers.

Nonetheless, the good news is that rates have started to turn, so it makes sense for all savers to get their money out of those zero-earning accounts and into something that offers a better return.

But while rates have risen, watch out for the small print. AIB, for example, only offers its market-leading 3 per cent fixed term rate to those with at least €15,000 to deposit (and you have to be an existing customer with a payments account – generally a current account – to open it), while AIB-owned EBS only offers the 3 per cent rate on its regular savings product to new customers.

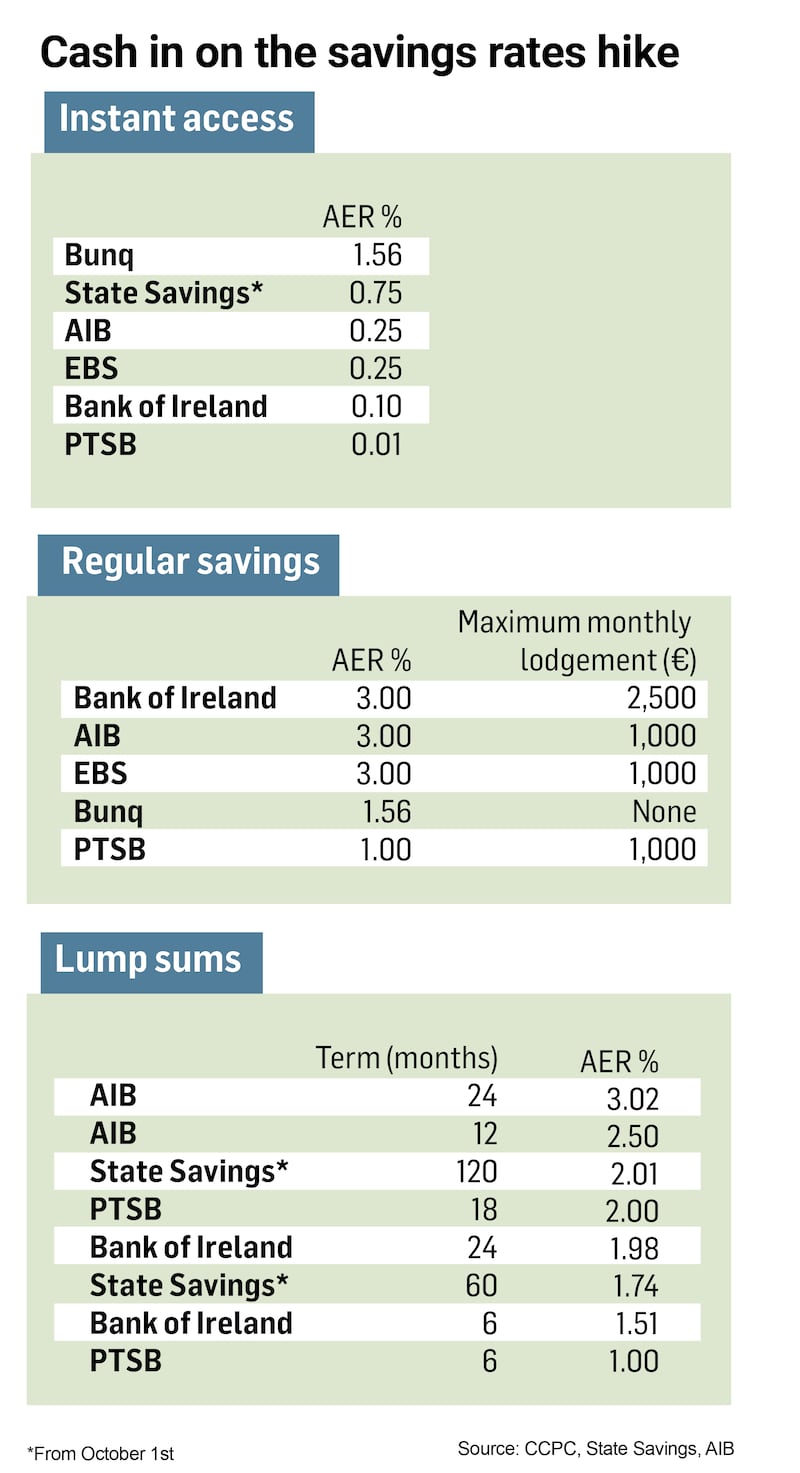

Instant access

Best State Savings deposit account (0.75 per cent)/Bunq (1.56 per cent)

Worst PTSB (0.01 per cent)

If you need to keep a certain amount of cash in an easy to hand account, you will always be stuck with the lowest rates.

State Savings recently announced that the rate on its deposit account would increase from 0.05 per cent to 0.75 per cent from October 1st, which puts it, alongside digital bank Bunq’s 1.56 per cent, as one of the better offerings on the market. However, unlike many State Savings offerings, this account attracts Dirt in the same way as other deposit accounts and it’s not available online, so you’ll have to go into a post office to open an account.

If you can cope with giving up to a week’s notice, you may do better. AIB, for example, has a rate of 0.75 per cent on its seven-day notice account, a better option than earning just 0.25 per cent in its demand deposit account.

Bear in mind that with State Savings fixed-term products, you typically only have to give seven days notice to end the term, so this is also a good option for those seeking higher rates, but who may also need access.

Lump sums

Best AIB (3.02 per cent AER over two years); PTSB (3 per cent AER over three years)

Worst PTSB (1 per cent AER for six months)

From September 12th, AIB has offered a market-leading rate of 3 per cent AER (annual equivalent return) on its two-year fixed term account. PTSB will follow on September 26th with a 3 per cent AER rate on its three year fixed term product.

However, the AIB account does have limitations, as mentioned above. You’ll need at least €15,000 to deposit in order to earn the top rate – a spokeswoman says that if you have less than this, the best option is its term notice account (0.75 per cent) or regular savings (3 per cent from today). Moreover, you need a payments account with the bank in order to be able to access this rate – the spokeswoman says the best way to do this, to avoid transaction fees and charges, is to open a demand deposit account first, which must be done in a branch.

Another option is the State Savings scheme, sold through outlets of An Post and online. The NTMA recently announced a much-anticipated increase in these rates, even if the increases don’t go quite as far as many would have liked.

Bear in mind that these State Savings rates don’t apply until October 1st – so don’t rush in just yet for a fixed-term product.

The best return will be offered over a 10-year term on the solidarity bond (2.01 per cent AER / 22 per cent gross), with an AER of 1.74 per cent available on the five-year savings certificate.

Of course, the key advantage of these savings products is that they are tax free, so you need to bear this in mind when comparing with other products.

Consider the three-year savings bond, which from next month will pay out 4 per cent gross, up from 1 per cent previously, over three years, at an AER of 1.32 per cent. If you saved €20,000 in that product, your return after one year would be €264. If you put the same sum into AIB’s 3 per cent product, your pretax return would be €600 – but you would have to pay Dirt on this of 33 per cent, or some €198, bringing your annual return down to €402.

It still beats the NTMA’s offering but it is worth being aware of the need to consider tax when comparing. If you’re only getting 2 per cent, such as at Bank of Ireland or PTSB, the State Savings product can be as attractive despite the lower headline interest rate, as the after-tax return on a 2 per cent rate will be €268 a year.

Regular savings

Best AIB/EBS/Bank of Ireland (3 per cent)

Worst PTSB (1 per cent, but will increase to 2.5 per cent from September 26th)

Regular savings products have languished at the bottom of return rates for quite some time. However, welcome moves of late mean you can now earn a decent return on what you might save each month.

From September 19th, both EBS and AIB will offer the best rate on the market, at 3 per cent rate on amounts of up to €1,000 a month. This follows Bank of Ireland, which increased its “super saver” account rate to 3 per cent, up from 2 per cent previously, on September 9th.

It means that those who are able to save the maximum of €1,000 each month will earn €194 in interest after a year; this compares with just €32 had they been earning interest at a rate of just 0.5 per cent.

Remember the typical caveat when it comes to regular savings: you have to remember to move your money at the end of the one-year term, otherwise you will earn less on it. With AIB’s regular saver, for example, once the amount exceeds the €12,000 it goes back to earn just 0.25 per cent in interest that will apply from today on demand deposit accounts. At Bank of Ireland, it goes back to 2 per cent on balances of up to €30,000.

Prize bonds

The NTMA also recently announced a welcome change in the interest rate that applies to the prize bond fund, which determines how much will be paid out in prizes each year. From October 1st, this will jump from 0.35 per cent to 1 per cent, which means the number of prizes is expected to double to half a million a year. The amount on offer will also rise – almost trebling to about €48 million.

The move means the prize fund will deliver a top monthly prize of €500,000 in the last weekly draw of every calendar month. This is double the €250,0000 currently on offer.

Savings locked away?

If you have recently locked your savings away for a fixed term at lower rates, you may need to think about how you can best access these.

If you’re with a bank, there will likely be penalties associated with breaking a fixed term. With Permanent TSB, for example, while you can access your savings early, you will have to pay a withdrawal charge, which will be deducted from any interest earned.

Or, you may not be able to access your savings at all. Bank of Ireland, for example, allows no withdrawals during the term of its 24-month deposit account.

If your money is with State Savings, on the other hand, now is the time to take action. While your money is “locked away” for terms of up to 10 years, no charges apply should you wish to access your money early. Instead, you typically need to give seven business days’ notice, and you will get your original investment back, plus any interest earned up to that point.

If you’re currently in a regular savings product, you may need to close this and open a new one to avail of the new higher rates.

With EBS’s Family Savings account, for example, the new 3 per cent rate will only apply to new accounts opened after September 19th – existing account holders will only get the current rate that applies for the term of their account. In addition, the rate drops to just 1.25 per cent in year two, so you may need to close and open a new account to keep getting the better rate.