Everyone from Moody's to the Central Bank and the International Monetary Fund is warning about affordability in the Irish housing market. And they're not alone. For the average worker looking to get a leg on to the property ladder in an urban area, soaring house prices are making it ever more challenging to do so.

But how difficult is it for a typical public sector worker or an electrician or retail manager earning the average wage to buy a house? And is it more difficult than it once was?

Looking back almost 25 years, we try to find out. There are some caveats to this; tax rates, rents, inflation, mortgage rates, availability of finance can all exert just as much of an impact on affordability, and it’s simply not possible to adequately account for all those factors in a report such as this.

Moreover, prices used to be based on “averages”, which can be pushed up by high prices for a small number of homes; today the CSO offers us “median”.

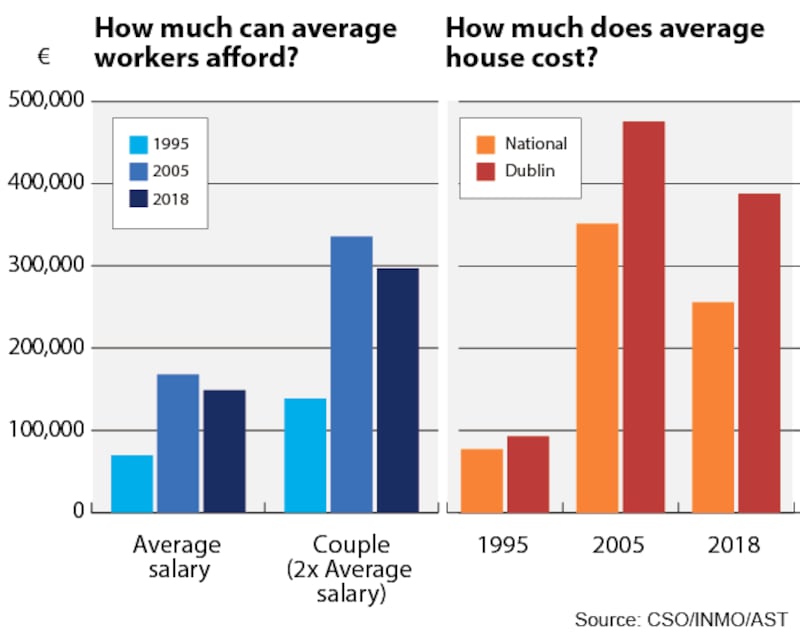

Nonetheless, our survey throws up some interesting findings. Back in 1995, for example, the average worker, on a salary of €17,873, would have needed a multiple of just 4.3 times their income to buy the average home nationally, rising to 5.2 in Dublin, and falling back to 3.4 times in Waterford.

Fast forward to 2005, and this income multiple had soared to almost 16 times in Dublin.

It has since fallen, and stands at about 6.7 times nationally. But in Dublin, it has edged up once more, and now stands at about 10 times the average income in the capital, highlighting the challenges faced by today’s cohort of first-time buyers.

What can they buy today?

If you consider a single person on the average earnings of some €38,199 a year, with a 10 per cent deposit and availing of an income multiple of 3.5 times incomein line with Central Bank rules, they can borrow €133,696. That will give them a target purchase price of €148,551.

But in today’s market, given the median sales price nationally of €205,000, a single buyer on these average earnings will effectively see themselves priced out of some markets, particularly in urban areas.

But, while Dublin may be impossible, with a median house price of €315,000, our table shows that the average person, on an average income will still be able to buy in Limerick and Waterford.

Now, if we give this person a partner earning the same income we’ll get a target purchase price of €297,103. So, provided that the couple can get a deposit of almost €30,000 together, they will be able to buy the typical house in Galway, Cork, Waterford and Limerick.

And not only that, but they’re not far off the median priced house in Dublin at €315,000.

But how do our nurses, teachers and gardaí fare?

Again, public sector workers would fare all right outside the major urban areas. On a salary of €44,000 (point seven on the pay scale) for example, a single teacher would have a budget of €171,111, more than enough to buy the average house in Limerick, Waterford and possibly Galway.

If a teacher and a garda were to buy together they would see their budget double to €342,222 – again provided that they could raise a deposit of €34,222. Based on median prices this would put them in a position to buy a property right across the State – and even in Dublin.

How about back in 2005?

Pre-bust, mid-boom, our average buyers would have struggled considerably. House prices were soaring to new highs, while that autumn the Ryder Cup rolled into town, with talk of suburban homes within 20 minutes of the K Club renting for €3,000 a week. A headline in this paper read: “Welcome to the €1 million standard semi-d”.

The frothiness and irrational exuberance created a difficult market for first-time buyers. Someone on average annual earnings in 2005 of €30,206, for example, would have needed an income multiple of a staggering 16 times to buy the average house in Dublin, then priced at €475,430, or 11 times to buy in either Cork or Galway.

Even at five times income, our average earner would have found themselves priced out of all urban areas in our survey.

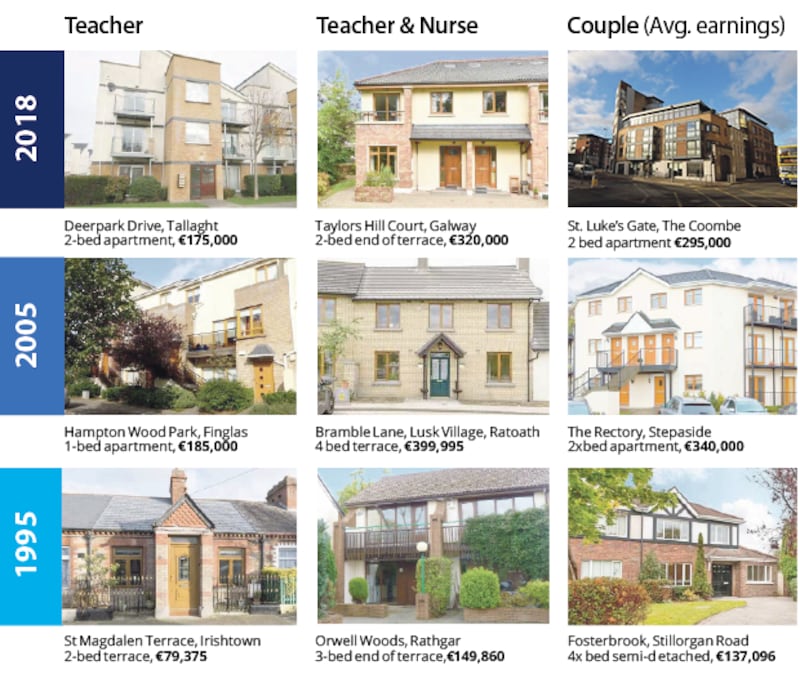

A teacher on a salary of €35,527 at the time would have been restricted to purchasing something like a one-bed apartment. Such properties were on sale at the time for €185,000 in Hampton Wood, Finglas. So our teacher may be faring slightly better today given that they can afford a two-bed in Tallaght rather than a one-bed in Finglas. Of course, they might still argue that it doesn’t meet their needs.

The one thing buyers had in their favour back then were loose lending rules. Income multiples of five times income were not uncommon, while 100 per cent mortgages meant first-time buyers did not have to downsize their lifestyles to save a deposit.

If they had a partner, or bought with a friend or sibling, as many did at the time, they could have doubled their purchase price to about €335,000; this would have allowed them buy everywhere but Dublin.

For example, a nurse and a teacher, on slightly higher than the average wage at the time, could have bought a four-bed terraced house in Lusk Village, Ratoath, Co Meath, then on the market for €399,995.

Of course, these loose multiples were a key factor in the negative equity into which so many borrowers plunged shortly after and which many rue to this day.

And in 1995?

This may have been a golden era for house-buyers. It is the only period where a single worker on the average income would have been in touching distance of buying the average home in Dublin – on their own.

The average salary at the time stood at €17,873, while the average house price nationally was €77,100 – or as low as €59,880 in Waterford. This means that, on an income multiple of just 3.5 times, a person on the average wage in 1995 could have bought their own home in Limerick or Waterford. If the multiple was boosted to four times income, they would have come close to buying in Cork or Galway too.

As our survey shows, our teacher could have afforded a two-bed terrace in Irishtown in those days, before Google moved in and house prices ratcheted up.

While higher interest rates were also a factor at the time, they had come off their historic highs of 16 per cent in the early 1980s, and 14 per cent in the early 1990s, to stand at 7 per cent in 1995.

However, it must be remembered that this was twice the average interest rate of 2005 of 3.65 per cent. That clearly does impact on affordability, although those who purchased at that time would have seen their monthly repayments slide pretty much steadily since.

When we look at two buyers on the average wage in 1995, our buyers have the pick of the bunch, with a potential purchase price of €139,000 based on income multiple of 3.5 times. In Dublin after all, the average home was selling for just €92,796.

And what about our public sector workers earning a little more than €20,000 at the time?

Well, again, the hotspots of Dublin and Galway would have been out of reach, but by doubling up our average public sector workers would have had a budget of €157,325 – more than enough for the average house anywhere in the State provided they could come up with a deposit of €15,000.

For instance, our two public sector workers could afford a three-bed in upmarket Rathgar (€149,860), while our two average earners could have afforded at that time to buy a four-bed in Fosterbook, off the Stillorgan Road (€137,096), or a “large” four-bed in The Gallops in Leopardstown (€114,236), while a three-bed in The Rise, Mount Merrion, was on the market for €117,475.

Significantly, the gap between the top end of the market and the average price wasn’t so wide either. For example, in the pricey neighbourhood of Foxrock, south Dublin, a four-bed detached house in the Cairn Hill development off Westminster Road would have cost you the princely sum of €266,700 in 1995 – or 70 per cent more than what the average couple could buy. Contrast that with today when a similar property would cost close to €1 million – or 236 per cent more than our average couple’s price target.