Are income taxes in Ireland too high? Instinctively, we all might argue that we pay too much tax, but it's worth considering the question in the context of international norms.

And thanks to some new research from the Irish Tax Institute, in conjunction with KPMG, which takes a look at tax rates across the world in 2021, we can get a sense of where Ireland sits in terms of tax. The results might surprise.

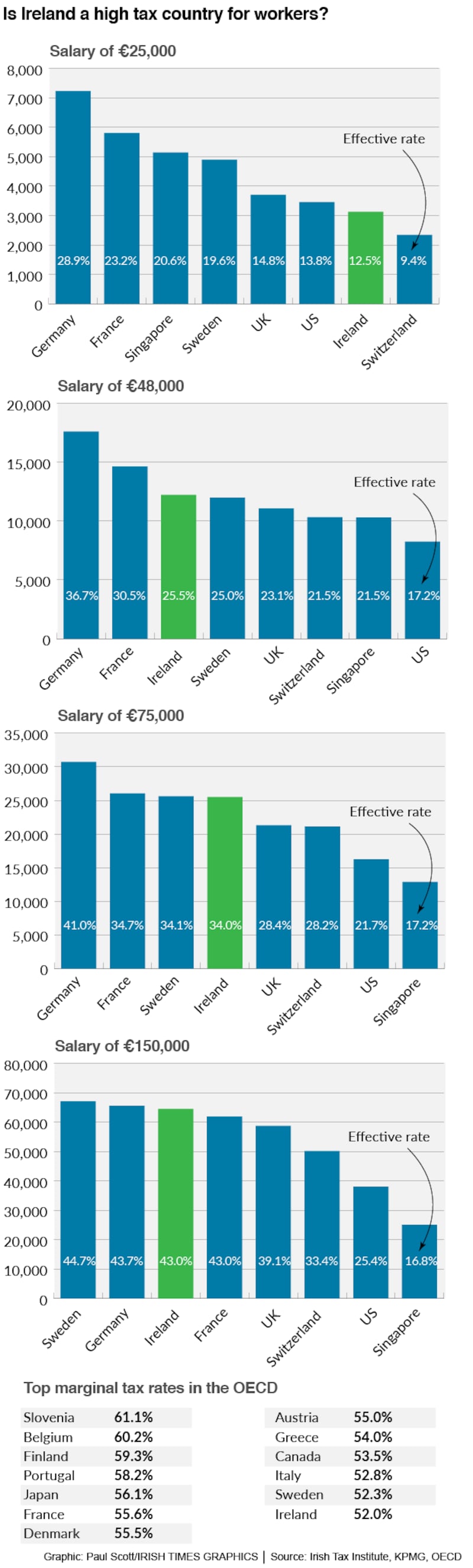

While someone earning €75,000 in Ireland will pay twice as much tax as someone working in Singapore on the same income, for example, an Irish resident earning €25,000 will pay just half as much tax as someone in Germany or France – and 39 per cent less than a worker in Singapore.

Higher earners: €150,000

Ireland's higher earners undoubtedly pay a considerable burden of tax – including income tax, PRSI and the universal social charge (USC) – when compared with other countries.

As the report notes, while the employee PRSI rate is comparatively low in Ireland, Irish taxpayers are subject to high rates of income tax and USC.

“Therefore, as income levels rise, taxpayers in Ireland move quickly up the international tables.”

On annual income of €150,000, an Irish worker is paying very close to the same burden of tax as a worker in high-tax Germany, with an effective tax rate of 43.7 per cent for the German-based worker, compared with 43 per cent for the Irish worker.

That means an Irish based worker on this level of income will lose €64,491 in tax every year – more than double the tax charge in low-tax Singapore (€25,131) and 41 per cent more than the burden in the US (€38,058). It is also 9 per cent higher than the €58,709 tax bill in the UK.

Middle income workers: €48,000-€75,000

For those in the middle, the tax burden in Ireland is also significant when compared with international trends.

Those on incomes between €48,000 and €75,000 find themselves surrendering between a quarter and a third of their incomes on tax – significantly more than their lower-paid peers, as we will see below.

This puts Irish middle-income earners towards the top of the tax-burden table, behind Germany and France, where social insurance charges are significant, but ahead of the UK, Singapore, and the US.

In Ireland, for example, a worker earning €48,000 a year will see 25.5 per cent of their income, or €12,223 a year, taken in income taxes. Contrast this with the US where the same worker will face a 17.2 per cent tax charge, or €8,247 a year. This means the US-based worker loses about a third less of their income in income taxes and social insurance than an Irish worker.

It’s still significantly better than Germany, where such an income will result in an effective tax rate of 36.7 per cent, or €17,596 a year.

It’s a similar story for the Irish worker on €75,000 a year, who will have a higher overall tax burden, at 34 per cent, and an annual tax bill of €25,491. This may be less than either Germany (41 per cent) or France (34.7 per cent) but is significantly higher than either the US (21.7 per cent) or Singapore (17.2 per cent).

Lower paid workers: €25,000

When it comes to those on lower salaries, the figures tell a different story. Thanks to the progressive nature of the Irish tax system – where the more people earn, the more tax they pay, and vice versa – lower paid workers in Ireland have a smaller tax burden than in many other developed countries. The OECD says that Ireland has the most progressive system of taxes and transfers of any OECD member.

So, though workers are hit with a variety of indirect taxes – such as VAT, excise and carbon tax – when it comes to the money they earn, those working in Ireland fare better on tax than in many other countries.

The figures from the Irish Tax Institute show that, for a worker on a salary of €25,000 a year, Ireland has the second lowest effective personal tax rate of all eight countries examined.

In Germany, for example, a worker on €25,000 a year will likely face an effective tax rate of 28.9 per cent, thus giving up more than €7,000 a year in taxes and social insurance. In France, the same worker will face a tax rate of 23 per cent, or 14.8 per cent in the UK.

In Ireland, however, the effective tax rate for such a worker is as low as 12.5 per cent, with a tax burden of €3,128 a year. This puts Ireland seventh out of the eight countries considered, ahead only of Switzerland, where the burden for such a worker is 9.3 per cent of their annual income, or €2,346 a year.

This is in part because the level at which you start paying income tax in Ireland is higher than in other countries. In Ireland, for example, you only start paying universal social charge on incomes of €13,000 and over.

It also means that a high proportion of Irish workers don't pay any tax on their income. Latest figures from the Revenue Commissioners show that this year, almost one million taxpayers, or some 34 per cent of income earners, won't pay any income tax. And 797,600 income earners won't pay USC (or income tax); that's 27.8 per cent of all income earners.

This is down on 2021, when 37 per cent were exempt from income tax, and 30 per cent from both – likely due to rising incomes.

It’s worth noting, however, that while the tax burden may be low for those on lower incomes, Ireland’s social insurance benefits are also low by European standards. A little bit of you get what you pay for, perhaps.

Top tax rates

Thanks to some research from the OECD, we can also get a sense of where Ireland sits when it comes to top tax rates.

Ireland is just about in the top third of countries when it comes to the highest tax rate that can be applied (including social insurance), ranking 13th out of 37 countries with a top rate of 52 per cent on income above €70,044 (that is income tax at 40 per cent, USC of 8 per cent and PRSI at 4 per cent).

This compares with Slovenia (61.1 per cent); Belgium (60.2 per cent); France (55.6 per cent) and the UK (47 per cent).

And 52 per cent is not even the highest rate of tax that can be paid in Ireland; those who are self-employed and earning more than €100,000 must pay a surcharge of 3 per cent, giving rise to a top tax rate of 55 per cent for this cohort.

Raising the income level at which people start paying the top rate of tax is not a cheap thing to do

Sinn Féin has called for a higher top rate of tax, through the introduction of a 3 per cent “solidarity tax” on individual incomes of €140,000 and above. This would bring the top rate of tax in Ireland for PAYE workers up to 55 per cent, and put Ireland in the top 10 OECD on income tax rates.

What’s also relevant is when workers start paying the top rate. In the UK, for example, the top rate of 47 per cent only kicks in on income over £150,001: in Ireland, a rate of 48.5 per cent (including social insurance) kicks in on income of just €36,800.

This is largely why there is a steep rise in the tax burden for middle-income earners.

Raising the income level at which people start paying the top rate of tax is not a cheap thing to do. According to the Revenue ready reckoner document for 2022, raising the level at which taxpayers start paying the higher rate of income tax by €1,500 (i.e. to €38,300 for a single person) would cost the exchequer €340 million in a full year.

Cutting the top rate of tax by one percentage point back to 39 per cent, would be even more expensive, at €404 million in a full year.