Sterling eased off peaks on Wednesday morning as UK prime minister Theresa May faced the hard task of selling her Brexit deal, while stocks tumbled as disappointing German GDP figures heightened worries over slowing global growth.

European shares fell as much as 1.2 per cent after data showed the German economy contracted for the first time since 2015, tracking similar losses in Asia where data in Japan and China underscored worries about weaker growth.

The weak open in Europe sent the MSCI’s world equity index down 0.3 per cent in early trade, while oil struggled to find a floor. The Iseq was 0.42 per cent weaker.

Sterling steadied just below a seven-month high versus the euro at around 87.17p and remained close to $1.30 after the UK and the European Union agreed on the text of a Brexit divorce deal.

Mrs May will try to persuade senior ministers on Wednesday to accept the draft agreement that opponents said would imperil her own government and threaten UK unity.

"After 873 days of bickering, point scoring, intransigence on both sides, and seemingly irreconcilable differences, we finally have a deal," said Deutsche Bank strategist Jim Reid.

“Now this easy part is out of the way along comes the hard part of selling it to a divided Parliament full of vested interests and factions,” he added in a note.

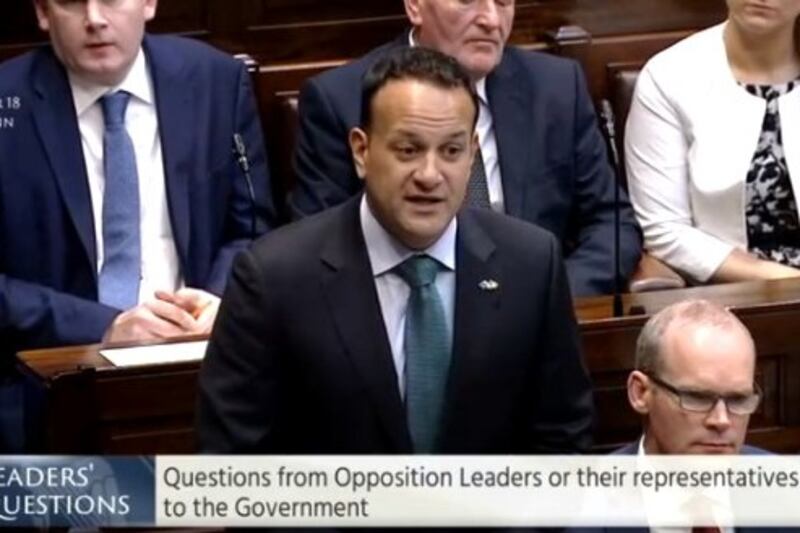

Parliament

The British cabinet will meet at 2pm. The deal must go through parliament for approval before the country exits the EU on March 29th, 2019.

Sterling/dollar implied overnight volatility jumped to 23 per cent, its highest since a general election in June 2017, signalling that investors were anticipating wild swings ahead for the British currency.

"Sterling volatility is expected to rise as the near term upside and downside risks crystallise," said Neil Wilson, analysts at Markets. com. "The cabinet will likely pass it but with assault from all sides of the house and Brexit divide, it seems impossible parliament will vote it through."

Meanwhile, oil attempted to rebound after plunging around 7 per cent the previous session, with surging supply and the spectre of faltering demand scaring off investors. – Reuters