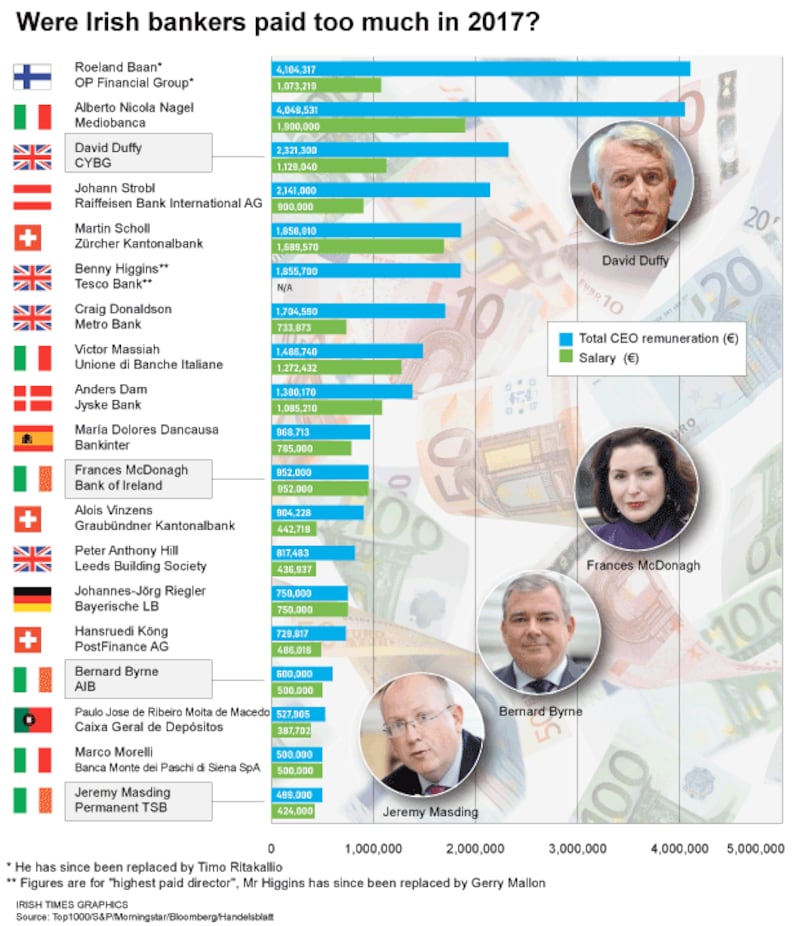

The chief executives of AIB and Permanent TSB are among the lowest-paid compared with their European peers, according to an analysis of remuneration among 20 banks of similar size by The Irish Times.

This reflects the ban on bonuses by the Government in banks bailed out by the State and a salary cap of €500,000 at those lenders.

In terms of total remuneration, PTSB's chief executive Jeremy Masding received the lowest, at €499,000, just €1,000 behind Marco Morelli, who heads Banca Monte dei Paschi di Siena in Italy.

In terms of salary, however, Mr Masding was not the worst-paid. His salary of €424,000 was higher than the €387,702 paid to Paulo José de Ribeiro Moita de Macedo, the head of Portuguese lender Caixa Geral de Depósitos, which is more than four times the size of PTSB with assets of €91.5 billion.

However, other remuneration plumps out his package to €527,905, putting him ahead of Mr Masding in overall terms.

AIB chief executive Bernard Byrne is next in the list with a salary of €500,000 and total remuneration of €600,000.

The highest-paid executive in the peer group was Roeland Baan, of Finland's OP Financial Group, with total remuneration of €4.1 million, and Alberto Nicola Nagel of Italy's Mediobanca at just over €4 million. OP has total assets of €142 billion, making it slightly bigger than Bank of Ireland.

Bank of Ireland boss Francesca McDonagh is the highest-paid executive at a State-involved bank here, with remuneration of €952,000.

Irish man David Duffy, a former chief executive of AIB and now the head of the CYBG group in the UK, is next in the list with total remuneration of €2.3 million, including a salary of just over €1.1 million.

Bonus ban

Our analysis examines the salaries and total remuneration paid to chief executives of 20 leading banks across Europe, which would be considered peers of AIB, Bank of Ireland and Permanent TSB based on the level of assets held on their balance sheets (ranging from €22 billion to €144 billion).

The pay cap and ban on bonuses has been cited in banking circles as the reasons why two senior AIB executives have announced their departures in recent times.

AIB's chief financial officer, Mark Bourke, who had total pay of €564,000 last year, is moving to Portuguese upstart Novo Banco, while Mr Byrne is moving to Irish stockbroker Davy.

AIB chairman Richard Pym recently said pay restrictions for bailed-out banks had turned AIB into a "training ground" for bankers who then move to higher-paid roles within the financial sector.

An absence of bonus payments is one of the reasons why Irish bankers earn less than their counterparts in similar-sized lenders in Europe. An effective 89 per cent special rate of tax on bonuses rate was introduced in 2011. Figures from Revenue show that not one banker received a bonus between 2012 and 2016.

In April, Minister for Finance Paschal Donohoe announced plans to appoint outside consultants to report back to him by the end of the year on compensation in the industry, saying it was appropriate to do so as some overseas firms seek to move activities to Ireland from London as they plan for Brexit – increasing competition for staff. This report is being carried out by Korn Ferry.

Agm vote

In the same month Mr Donohoe voted against a resolution at AIB’s annual general meeting that sought to reintroduce bonuses at the lender for up to 100 top executives from next year.

Mr Donohoe abstained from a Bank of Ireland remuneration resolution around the same time, which gave the bank the imprimatur to engage with major shareholders on “the adoption of an appropriate incentive scheme” in the future.

Irish bankers are not the only ones to be subjected to a pay cap, which was introduced here in 2009. AIB remains 71 per cent owned by the State, while taxpayers have 75 per cent ownership of PTSB and 14 per cent of Bank of Ireland.

Salary figures are not known for the chief executives of other banks operating in Ireland, such as Wim Verbraeken of Belgian bank KBC, and Jane Howard, newly appointed to lead Ulster Bank, which is part of Royal Bank of Scotland.

One of her predecessors, Jim Brown, was once the highest-paid banker in Ireland, achieving total pay of €1.63 million in 2014.

Italian lender Banca Monte dei Paschi di Siena, for example, was bailed out by the state in 2017. With a 68 per cent stake in the institution, the Italian government imposed a pay cap of €500,000 on chief executive Marco Morelli last year.

Double desire

Johannes-Jörg Riegler, chief executive of Bayerische LB, Germany's second largest state-owned Landesbank, started at the bank with a salary capped at €500,000. It has since stretched to €750,000, however, and German newspaper Handelsblatt has reported that he would like this doubled when his contract is up for renewal in February 2019.

If he achieves this, it would put him far ahead of Mr Masding at PTSB, even though the two banks are of similar size, with assets of about €23 billion.

Leeds Building Society chief executive Peter Hill is set to step down from his "dream job" in February next year. In spite of being of a similar size to PTSB, with assets of €22 billion, Mr Hill earned the equivalent of €817,483 last year.

Italian lender UBI Banca is the third-largest Italian commercial banking group in terms of market capitalisation. It is of a similar size to Bank of Ireland, with assets of €127 billion, but its chief executive, Victor Massiah, was paid a salary of more than €1.2 million in 2017, and total remuneration of close to €1.5 million.