The recovery in the Irish jobs market since the crash has been extraordinary. First job numbers picked up in some sectors, then across the board and now earnings are finally rising too. But who are the big winners – and why are many, even on reasonable earnings, still juggling to pay all the bills? To understand that, we need to stand back and look at exactly what is going on and put the key numbers in context.

1. The key numbers

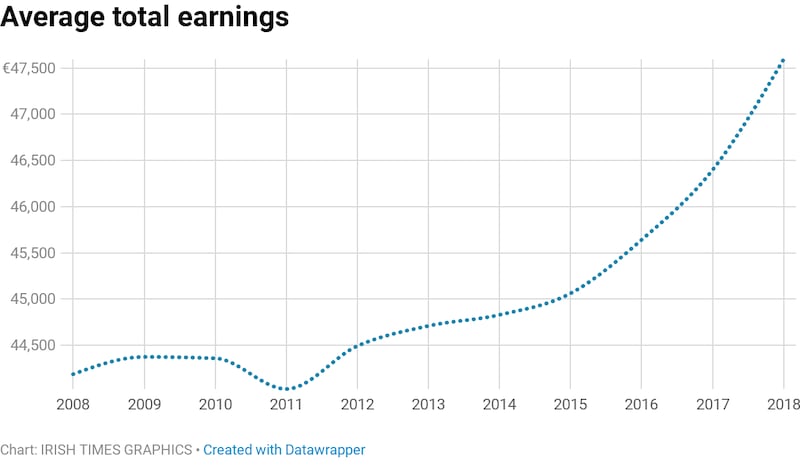

Earnings were essentially stuck and hardly moved for a prolonged period, even as the economy recovered. So upward earnings momentum has been a recent phenomenon. The jobs market turned in 2013, but while earnings started to edge up in 2015 , it was late 2017 before any significant upward move was evident – a low-inflation environment and plenty of slack in the jobs market in the wake of the crisis helped hold down earnings in the early period of the recovery. Many employers, notably the State itself, also took time to regain any kind of financial equilibrium.

Looking at full-time earnings (see graph), there were rises of 1.3 per cent in 2016, 1.7 per cent in 2017 and 2.7 per cent last year. Overall earnings, counting in part-time work, rose 3.3 per cent last year and figures for the first three months of this year show this trend continuing, with the annual growth rate edging up to 3.4 per cent.

Still, the gains are starting to add up. Average earnings have risen by around 10 per cent since 2013 and stand at around €40,000 at the end of the first quarter. Full-time earnings were just under €48,000 on average at the end of last year, up 6.5 per cent since 2013. If this momentum can be sustained for a few years, then it becomes more noticeable.

And of course many are moving out of unemployment into work, or moving to a better paid job – and this is significant for the overall economy as well as the individuals involved. Total earnings across the economy rose by 7.4 per cent last year, made up of a 4 per cent rise in the numbers at work, a 2.8 per cent increase in average hourly earnings and a 0.4 per cent increase in average hours worked.

2. The real gains

While earnings growth has been modest enough by historical standards, we are in an era of extraordinary low inflation. Only in recent months has there been a sign of a possible inflation pick-up, with the rate rising to 1.7 per cent in April, before easing back to 1 per cent in May, a trend to watch in the months ahead.

Low inflation means almost any level of wage increase has, on average, led to real – of inflation-adjusted – gains over the past few years. So average earnings growth of 3.3 per cent last year was way ahead of the consumer price inflation rate of 0.5 per cent for the year.

Over the past five years, the 10 per cent rise in wages compares to inflation totalling (not averaging!) 0.8 per cent. So real gains have exceeded 9 per cent, when compared to the average basket of goods and services. So why doesn’t it feel as good as that? There are a few reasons.

One, as we have written about before, is that Ireland is a high-cost country. The latest Eurostat figures show that Ireland is the second most expensive place to live in the EU, after Denmark, based on an assessment of a basket of 2,000 goods and services, with prices 27 per cent above the EU average. So despite low inflation in recent years, the actual level of prices remains high and so those on lower than average incomes may continue to struggle despite some rise in their wages.

The second is that most people in employment, beyond the lowest paid, are paying significantly more in income tax than they did before the crisis hit. So while gross earnings may now be above pre-crisis levels, real spending power has still to catch up. This is particularly an issue for middle and higher earners, with lower earners paying relatively low income tax and social insurance here compared to the international average.

A study by the Irish Tax Institute last year showed take-home pay at a variety of average income levels was 3 to 5 per cent lower than before the crash, while for higher earners losses were 6 to 8 per cent. While "pre-crisis" income tax rates were arguably too low, the relatively high tax take on middle incomes is an ongoing policy issue here.

The third issue is that the consumer price index, the traditional measure of inflation, is an average measure, but does not reflect prices pressures felt by some households, particularly in the area of housing. This is an issue not only in Ireland, as a recent OECD study showed, but is something affecting the middle class across the developed world, with housing costs now typically accounting for a third of spending, up from a quarter during the 1990s.

This is a big factor squeezing the finances of the middle class, according to the OECD, and limiting the ability of many younger people to home-ownership.

Here, for people buying a home, servicing a large pre-crisis mortgage or in the rental market, the level of earnings increase in recent years will often not have appeared significant. Rising childcare costs have been another key factor. In contrast, for typically older employees already owning a home, there has been, on average, a rise in spending power from wage rises.

3. The big winners

The other notable factor in the jobs market has been the disparity in wage increases across different sectors. There is a big gap not only between wage levels, but also the rate of increase. And some of the sectors with the highest wage levels have also been seeing the biggest rises, though accommodation and food services, traditionally one of the lowest paying, has also registered a significant gain. Notably, earnings increased across all sectors last year.

The highest paid sector is, not surprisingly, information and communications, where pay averaged €61,269 last year, up a hefty 7.9 per cent annually and 15.5 per cent ahead over the past five years.

The second best paying category is finance, insurance and real-estate, up 5.2 per cent last year and 13.1 per cent over the past five years. At the far end of pay scale, earnings in accommodation and food services, where hourly levels are lower and there is more part-time work, was €18,262 last year, up 3.7 per cent on the year and 13.5 per cent since 2013.

In the biggest sector in terms of the total wage bill across the economy – industry – the average earned is €46,399, up 2.6 per cent last year and 9.1 per cent over the past five years. Construction earnings rose 5.7 per cent last year to just over €40,500. Earnings in public administration rose 1.7 per cent last year and are up 3 per cent over the past five years.

Interestingly, the education sector retains its place as the highest for average earnings per hour of €35.82, with the lowest average weekly hours worked of 23.7. In the ICT sector pay per hour is €32.29, with average weekly hours of 36.5.

Longer term trends are also interesting. Construction was, not surprisingly, a sector where average pay levels fell heavily during the crash, only recovering to above 2009 levels last year. The overall public administration and defence sector has still to recover to pre-crash levels on average, though redundancy programmes which saw higher paid employees leave – thus reducing the average wage bill as new recruits would be generally lower paid – are also a factor here. In many other sectors pay stagnated or fell slightly during the crash and is now well ahead on a 10-year view.

Interesting new research by jobs website Indeed and the Central Bank shows that the jobs market for some categories of highly skilled jobs is now very tight – meaning wages here are likely to continue to rise strongly, while in other areas they may continue to lag.

The research looked at what jobs were getting relatively small numbers of clicks on the website, illustrating that few people saw themselves are qualified. Not surprisingly these included highly skilled jobs in areas of healthcare, finance and engineering such as senior fund accountants, senior mechanical designers, tax directors, corporate lawyers and a number of nursing and medical posts. In contrast job ads in areas such as van driver, babysitter and floor staff got a large number of clicks – and thus employers are likely to be under less pressure here to increase wages to attract people who can do the job.

The bottom line

The bottom line is that the jobs market is at an interesting point. There were expectations that hiring would slow as unemployment falls to lower levels, leading to more upward pressure on wages. But figures for the first quarter showed remarkably strong growth in total employment continuing and wage growth, while it has picked up, has not accelerated rapidly across the board. However there are clearly wage pressures in some sectors leading to rapid earnings growth. Whether this spreads more widely will likely depend on the overall state of the economy, which is currently very strong, but faces the imminent uncertainty of the shape Brexit will take.

Smart Money is a weekly online column which looks at the big economic trends and what they mean for you.