The slowdown in property prices is continuing with the latest official figures showing annual inflation was just 2.8 per cent in May, the lowest level recorded in six years. This was also down from 12.4 per cent just 12 months ago.

The annual price rise in Dublin, where supply pressures are most acute, was 0.6 per cent. The highest house-price growth in the capital was in south Dublin at 4 per cent, while Dún Laoghaire-Rathdown, conversely, experienced a decline of 2.6 per cent.

The rapid slowdown in property-price inflation has been linked to the Central Bank’s tough mortgage lending rules. However, critics say the rules have simply transferred housing pressure to the rental sector, as evidenced by the 7 per cent rise in rents last year.

Residential property prices in the Republic, excluding Dublin, were 5.1 per cent higher in the year to May, according to the latest figures. The region outside of Dublin that saw the largest rise in property prices was the Border at 15.2 per cent, while the smallest rise was recorded in the mid-east at 0.5 per cent.

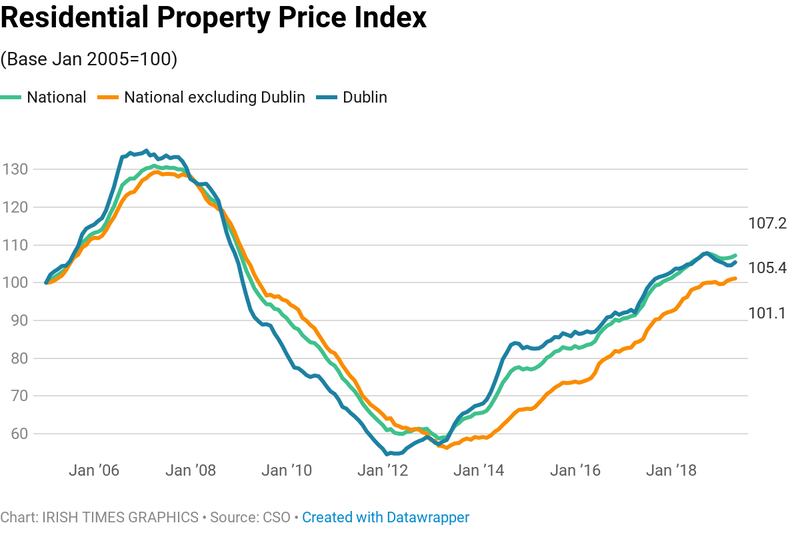

Property prices nationally have increased by 82.6 per cent from their trough in early 2013. Dublin residential property prices have risen 93.4 per cent from their February 2012 low, while residential property prices in the rest of the State are 79.9 per cent higher than May 2013.

The figures also reveal that households paid a median price of €251,000 for a home on the residential property market in the 12 months to May.

The Dublin region had the highest median price of €366,000 in the year to May. Within the Dublin region, Dún Laoghaire-Rathdown had the highest median price at €538,000, while Fingal had the lowest at €334,999.

The Central Statistics Office said the highest median prices outside Dublin were in Wicklow (€315,000) and Kildare (€295,000), while the lowest median price paid for a home was €100,000 in Leitrim.

“So, there has been a clear shift in the trajectory of Irish housing prices towards a broadly stable and ultimately more sustainable path through the past 12 months,” said KBC Bank economist Austin Hughes.

He noted that Irish house prices were now rising in line with weekly average earnings growth (up 3.1 per cent year on year in the first quarter 2019).

“The softer trend in Irish house prices of late reflects a range of factors including increased supply, concerns around Brexit, and likely of most importance recently, affordability constraints,” he said.

Joey Sheahan, head of credit at mymortgages.ie, said property-price growth underpins the need to extend and expand the Help to Buy scheme.

“Yes, price growth has slowed, but ultimately, prices are still rising – and faster in some parts of the country than others,” he said. “This means that thousands people are still finding it difficult, if not impossible, to get the deposit they need together to purchase a property they want.”