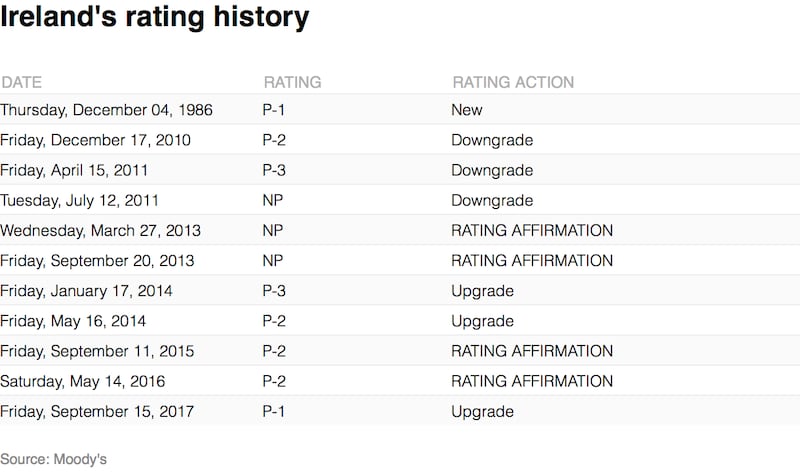

The Republic, whose credit rating has been lifted from “junk” and raised five levels in the past four years by Moody’s, has a “very slim” chance of continuing at the same pace and reclaiming a triple-A rating within the next five years, according to the firm’s lead analyst on Ireland.

While Government debt has plunged from 123 per cent of the size of the economy in 2013 to about 70 per cent last year, "there is a requirement for debt to be materially lower than it is now" to return to a Aaa rating, Moody's lead analyst on Ireland, Kathrin Muehlbronner, said in an interview with The Irish Times on Tuesday.

Volatility

Ms Muehlbronner said that while the State’s “immense growth volatility is beneficial at the moment” and it “is really in a sweet spot”, the Republic needs to have “larger buffers than a country that is less volatile, which means you have to have lower debt – all else being equal”.

Moody’s awarded Ireland its top grade in 1998 before reducing it to “junk”, or non-investment grade, in 2011 after the collapse of the property market crippled the State. The ratings firm has upgraded Ireland a number of times since it exited its international bailout in 2013, moving most recently last September to raise its stance to A2, which remains five levels below its top grade.

The latest move comes “despite huge uncertainty around Brexit and our view that Ireland will be the country that is likely to be the most affected”, Ms Moehlbronner said.

The other key risk facing the Republic is US tax overhauls signed into law by US president Donald Trump late last year, cutting the country’s corporate tax rate from 35 per cent to 21 per cent, according to Moody’s.

The analyst said the move is unlikely to have a large impact on the extent to which US multinationals are currently invested in the Republic. However, it is likely to have an impact on future investments.

A report by Moody’s last year estimated that US groups account for about 60 per cent of all corporate tax paid in the State, noting the exchequer’s company tax haul has increased significantly in recent years to beat Government targets.

Assumption

“Our basic assumption is that the companies – some of whom have been here for a very, very long time – feel happy here. There’ll still be multinationals and Europe will remain a very important market for them, so why should they move?” said Ms Muehlbronner. “But for US corporations in general, it will be less attractive to offshore [ in future to] Ireland or elsewhere.”

Speaking earlier at a Moody’s conference in Dublin, Ms Muehbronner noted that the Republic’s market borrowing costs have been most helped in the currency area from the ECB’s €2.5 trillion quantitative-easing (QE) bond-buying programme, which is being phased out.

Ms Muehlbronner noted the ECB’s QE programme, introduced in 2015, shaved about 1.5 percentage points off the Republic’s 10-year government bond yields, marginally more than the second main beneficiary, Portugal.

However, she said the State has also benefited from efforts to cut its budget deficit and reform its banking sector since the height of the financial crisis.

“Ireland certainly is the one sovereign where the rating has improved the most from the crisis period,” she said.

Looking at Europe as a whole, Ms Muehlbronner said the economy is growing at its fastest and most broadbased pace since the onset of the financial crisis. However, she said that limited progress on structural reforms – from labour market to fiscal overhauls – will affect the current cyclical recovery feeding into longer-term growth.