Euro zone businesses have reported their fastest expansion in activity for more than two decades, bolstering economists’ hopes of a rapid rebound this summer despite the spread of the Delta coronavirus variant.

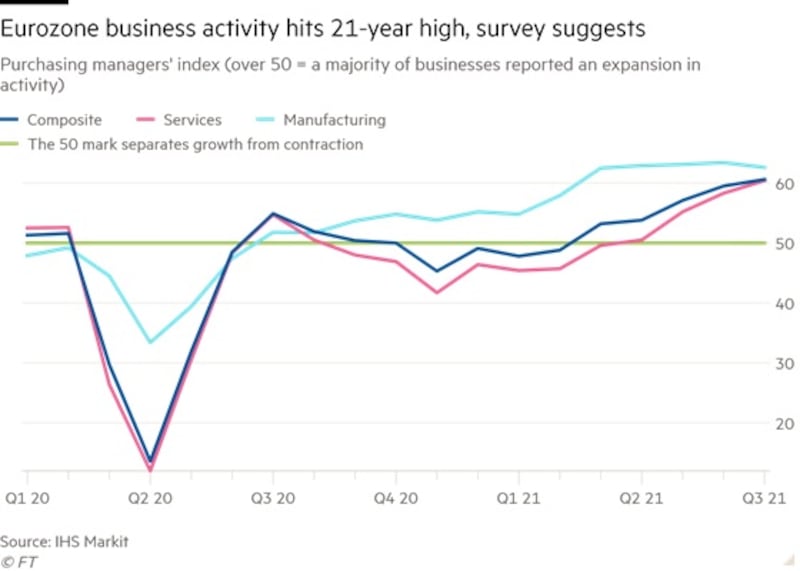

IHS Markit’s flash composite purchasing managers’ index - based on a survey of eurozone businesses - rose to 60.6 in July, up from 59.5 in June. A score over 50 indicates a majority of businesses reported an expansion in activity from the previous month.

It is the highest Purchasing Managers’ Index (PMI) reading for the eurozone since July 2000 and narrowly outstripped the expectations of economists polled by Reuters, who had predicted a reading of 60. Eurozone companies’ orders rose at the fastest pace for 21 years.

The data indicate that the euro zone economy is growing at a healthy rate after Covid-19 lockdowns were lifted in the spring. Second-quarter output data due to be published next week are expected to show that the bloc has emerged from its double-dip recession, and the PMI figures indicate that the recovery is continuing in the third quarter, economists said.

“The euro zone is enjoying a summer growth spurt as the loosening of virus-fighting restrictions in July has propelled growth to the fastest for 21 years,” said Chris Williamson, chief business economist at IHS Markit.

UK reports slowdown in expansion

By contrast, businesses in the UK reported a slowdown in the pace of expansion, as rising infections, subdued customer demand and shortages of workers weighed on the economic recovery despite the recent relaxation of Covid-19 curbs.

The flash, or interim, UK PMI published by IHS Markit and the Chartered Institute of Procurement and Supply fell to 57.7 in July, down from 62.2 in the previous month although still in expansionary territory.

The reading was lower than the 61.7 forecast by economists polled by Reuters, but remained well above average.

The euro zone survey also found some early signs that the economic rebound may be close to losing steam. Business expectations for the year ahead dipped to a five-month low, down from an all-time high in June.

Ricardo Amaro, senior economist at Oxford Economics, said this showed “renewed virus-related headwinds have resulted in a deterioration of the balance of risks”.

Many euro zone companies are struggling to keep up with rising demand, which is causing shortages of materials such as semiconductors and steel and driving up the selling prices of goods and services.

The PMI for euro zone manufacturing dipped to a four-month low of 62.6, remaining at a historically high level and indicating a continued expansion of activity but showing more signs of being hit by supply bottlenecks and lengthening delivery times.

“Supply chain delays remain a major concern for manufacturing,” Williamson said.

By contrast, euro zone services businesses reported their strongest rise in activity for 15 years, as they benefited from the easing of lockdown measures and a pick-up in consumer spending. The services PMI rose to 60.4, up from 58.3 in the previous month.

IHS Markit said increasing demand and supply constraints caused average selling prices for euro zone goods and services to rise “at a near survey record pace in July”, indicating that inflationary pressures continue to build, particularly in manufacturing.

“The recent surge in consumer prices across both sides of the Atlantic shows that sellers and distributors are trying to pass on the rising costs to consumers,” said Kallum Pickering, an economist at Berenberg. “Further upside surprises to inflation data are possible.”

Analysts have been increasing their predictions for euro zone inflation, according to the European Central Bank’s quarterly survey of forecasters released on Friday. Average expectations for inflation this year rose from 1.6 to 1.9 per cent and for next year from 1.3 to 1.5 per cent. Their predictions for 2026 inflation also advanced from 1.7 to 1.8 per cent. – Copyright The Financial Times Limited 2021