Textbooks suggest that economies and those who operate in them adjust to changing circumstances and incentives. And we have indeed seen major changes in the way many businesses are organised due to the Covid-19 shock. But the fallout from another event – Brexit – presents an extraordinary case study of the speed with which export and import patterns alter and businesses adjust in response to changes in the trade regime.

Britain left the EU single market and customs union at the start of last year; Northern Ireland remained in the single market for goods and, under the Northern Ireland protocol, follows some EU customs rules.

To summarise the story, imports from Britain to Ireland have fallen sharply, exports from Ireland to Britain have held up

Economic theory would suggest that trade flows would change as new regulatory barriers faced those trading with Britain – or even moving their goods through Britain on the way to the Continent. But the pace at which this has happened has been remarkable.

To summarise the story, imports from Britain to Ireland have fallen sharply, exports from Ireland to Britain have held up and cross-Border trade has increased very significantly.

The import trends relate to the imposition of new customs checks and controls on importers – and on UK exporters – which have increased bureaucracy and costs. The UK-EU trade deal means that, in most cases, tariffs do not apply: we are talking instead about what are called non-tariff barriers – the paperwork, rules and checks which economists warned could have a big impact.

Tariffs can also apply if the goods coming in from the UK originated in a third county – another area of real complexity.

Exports from Ireland to Britain have, however, not yet shown the same Brexit impact. The fact that the UK has not yet implemented the detailed checks and controls expected post-Brexit has helped, though there has been a fall-off in the key food sector.

Meanwhile cross-Border trade has benefited and there has been a major re-routing away from the landbridge.

Trend comparison

A recent working paper by Eimear Flynn, Janez Kren and Martina Lawless, economists in the Department of Finance, the Economic and Social Research Institute and TCD, unravels the different threads of the story and how much of the change can be attributed to Brexit. There is one missing piece of evidence – trade figures between Northern Ireland and Britain are only published on an annual basis. But otherwise there is a basis to make a comparison of pre- and post-Brexit trends.

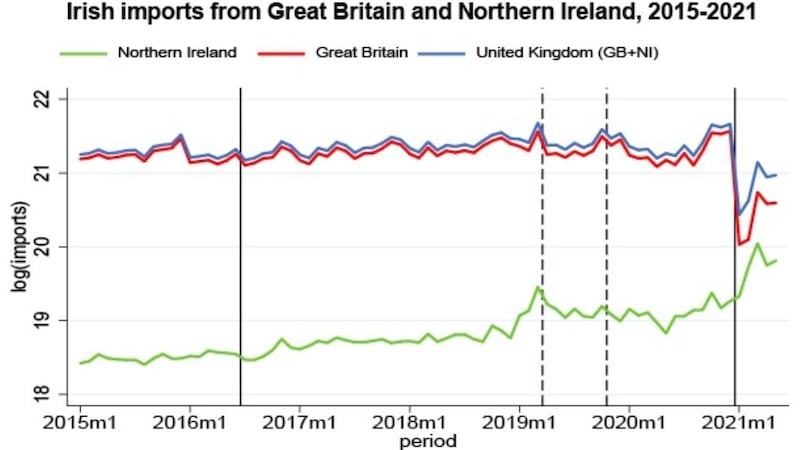

Using data from 2015 – before the Brexit vote in June 2016 – and 2021, the paper finds a clear divergence in how Brexit has impacted trade with Britain and that with Northern Ireland.

Imports from the UK have been on a downward trend and have declined from 25 per cent of total Irish imports in 2015 to just 12 per cent earlier this year. Mining the figures, the researchers found a definite Brexit impact here, with imports from Britain falling after Brexit but those from Northern Ireland picking up. While other factors are at play, Brexit is found to be by far the most important in these trends.

While the increased imports from Northern Ireland are not as large in money terms as the fall in imports from Britain, the researchers find that “the increase in Irish trade with Northern Ireland is significant and is likely explained by changes to supply chains, be it as a result of substitution by Irish and UK firms or firms redirecting trade through Northern Ireland, as well as more accurate reporting of Northern Ireland trade by UK firms since Brexit”.

In sectors like beverages, for example, there is a notable jump in import levels from Northern Ireland – up 82 per cent in total – and a fall from Britain.

Looked at another way, Northern Ireland now accounts for 21 per cent of all UK imports into Ireland, up from 12 per cent in 2015. However only when figures for trade between Northern Ireland and Britain become available will researchers be able to confidently estimate how much of the rise in cross-Border trade post-Brexit is due to a switch in trade which had previously gone across the Irish Sea.

Total exports

There has been a much less dramatic impact on Irish exports to the UK, with no evidence so far of an overall hit from Brexit, but a decline in sectors like food showing a sectoral impact.

If the UK triggers article 16 of the Northern Ireland protocol it could set off a chain of events that could threaten to undermine the withdrawal agreement itself

The percentage of Irish exports going to the UK has fallen from about 12.4 per cent of total exports in 2015 to 8 per cent now, but the impact of Brexit is evident in the key food and beverage sector, where there has been a fall in sales to Britain, though again an increase in sales to Northern Ireland.

The UK government last month announced that the imposition of further Brexit controls on imports from Ireland into the UK, due to come into effect on January 1st, had been postponed. In other words, goods moving from Ireland to Britain still face much fewer checks and paperwork than goods moving the other direction.

However, there may be a more significant impact on overall exports to Britain when these do eventually come into force. As the paper says: “This suggests that it may take further time for the full effects of Brexit to materialise.”

The changes in trade flows, meanwhile, look to be deep and long-lasting. To take just one further example, threats of delays, bureaucracy and additional cost using the landbridge have, the Irish Marine Development Office estimates, led to 20 new direct services being opened up from Ireland directly to continental EU markets.

Talks over the Northern Ireland protocol, meanwhile, could yet lead to more upheaval. If the UK triggers article 16 of the Northern Ireland protocol it could set off a chain of events that could threaten to undermine the withdrawal agreement itself and the tariff-free access which Irish exporters have to the British market. So far, however, this is unclear.

Irish business has so far navigated many of the threats from Brexit, but will be wary that more could yet be to come.