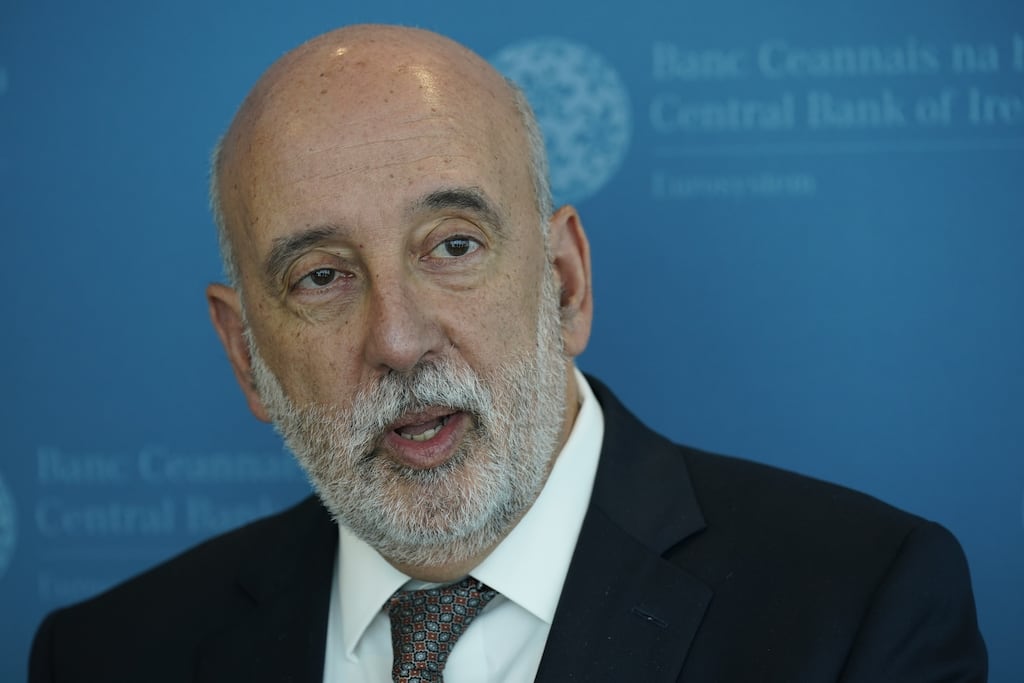

The European Central Bank shouldn’t rush into a decision to cut interest rates but remain “very vigilant” of risks that wages might be rising at too fast a clip, according to Irish Central Bank governor Gabriel Makhlouf, who is also a member of the ECB’s rate-setting governing council.

The labour market is “amazingly resilient” and economic growth should pick up in the second half, Mr Makhlouf said in an interview, urging patience. The situation should become “a lot clearer” in the middle of the year.

“Wage growth may go in the wrong direction in the sense that there may be too much of a catch up,” Mr Makhlouf said in an interview in the Belgian city of Ghent, where he was attending a meeting of European finance ministers and central bank governors. “If I can, I prefer to take decisions based on a clear picture” and “we can afford to wait.”

ECB policymakers are zeroing in on labour costs as key driver of inflation that will help determine the future course of interest rates. While pressure on negotiated wages eased at the end of last year, a new forward-looking indicator signals that elevated pay growth has yet to reach an inflection point.

RM Block

Mr Makhlouf said disinflation in the euro zone is well under way, even though more progress is needed before the ECB can lean back.

“We don’t have to wait for inflation to get to 2 per cent before deciding on rate cuts, but we do need to feel that we’ve got enough information that tells us actually we’re going to hit 2 per cent in a sustainable way,” he said.

His remarks come less than two weeks before the next ECB monetary policy meeting at the beginning of March, with officials increasingly converging around June as the most appropriate juncture to start lowering borrowing costs – even if some have suggested they may be in favour of a move before that.

“I’m completely open-minded about the rate path,” Mr Makhlouf said. “If the economy is still on a glide path, which we’re seeing at the moment, we won’t have to make rash decisions.”

The euro zone narrowly avoided a recession in the second half of 2023 and prospects remain weak, even though recent surveys point to stabilisation at a low level. At the same time, progress on inflation has stalled in recent months.

Mr Makhlouf pointed to economic weakness as an indication that monetary policy has been effective in dampening demand.

“My expectation is that we’re probably going to see a continuation of the slowdown in the first half of this year, but then a pick up in the second half – partly because the catch-up process of nominal wages will help consumption,” he said. “I don’t see a recession in a sense of a broad-based downturn.”

He argued that “politically induced problems” are a concern that policymakers must be alert to. “We’re living in a riskier world.”

Mr Makhlouf also spoke about the need to complete Europe’s capital-markets union.

“Part of the capital markets union challenge is that there are some topics, areas, subjects that are politically very complicated. We’ve tried to manage everything, and maybe that’s not the best way to go,” he said. “There’s something in focusing on the big things. Maybe that’s the way of making progress.

“I don’t think you need a crisis to get a capital markets union. You need political will and a narrative that helps to explain to the community what’s going on and why it’s going on.”

Talking about Ireland commercial property market, he said the Central Bank was “keeping a very close eye on it but at the moment we feel that the system is resilient enough to manage the falling valuations and the slowdown”.

Asked about competition in the Irish banking sector, the Central Bank chief said, as regulator, it wanted a competitive market, “but maybe three domestic retail banks plus lots of fintechs offering different types of services actually is the future”.

“In a few years, the competition authority may want to review the state of retail banking in Ireland. But I wouldn’t say that they will conclude that it’s a problem.” – Bloomberg