For years, it’s been the same old mantra: if you want to make property more affordable, build more homes. It’s a simple case of supply and demand, the construction industry tells us.

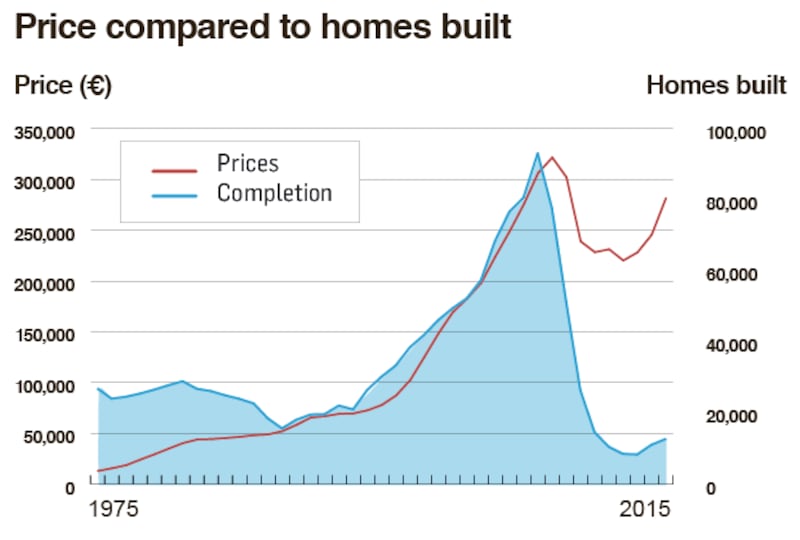

But not once in 40 years has an increase in the supply of new homes led to a fall in property prices here. Even at the high water mark of construction in 2006, when a record 92,000 homes were built, property prices rose by 14 per cent.

Although that was a credit-fuelled boom it illustrates an essential point about modern property markets – supply is not a driver of price.

In fact, the opposite is true. Supply tends to be led by price albeit after a lag, which is consistent with the idea that rising prices and rents make development more commercially viable.

This is the essential thrust of a recent paper in the Engineers Journal by Dublin architect and property expert Mel Reynolds.

Having studied the undulations of prices and rents over an extended period, he concludes that the Government's plan to make housing more affordable, envisaged in its Rebuilding Ireland strategy, is destined to fail.

Not that it won’t boost supply, it just won’t produce affordable homes or those within the reach of average incomes.

This is because the standard supply and demand paradigm – produce more and the price will come down – doesn't apply to property, Reynolds says.

Developer earnings

“The more expensive a banana gets the more likely someone is going to buy an apple, the more expensive a house gets the more likely someone is going to trade up or buy more of them.

“Property behaves like a luxury good. The more expensive it becomes the more desirable it becomes and the bigger the potential capital gains,” he says.

The Government’s plan to crank up housing supply to a target level of 25,000-30,000 units a year – it’s currently at about 15,000, though this figure is disputed – will deliver a greater choice of what Reynolds describes as “executive homes”.

By this, he means homes in the €350,000 plus bracket, ideal for professionals fleeing London in the wake of Brexit, but too costly for those on average incomes and outside any reasonable definition of “affordable housing”.

While there is no specific pricing level that equates to affordable housing, Reynolds suggests a maximum of €280,000 might be a fair estimate. The calculation is based on a two-income family earning €80,000 and qualifying for a mortgage, under the current rules, of €280,000.

Juxtapose this spending power with the average sales price for a home in Dún Laoghaire last year, which was €450,000 or the average rent paid, which was €2,200.

People might quibble with the use of Dún Laoghaire as a barometer, given it contains some of the city’s most exclusive addresses, but Reynolds says “Dún Laoghaire is where the rest of Dublin will be in two years”.

In any case a search on property website Daft.ie brings up very few new Dublin developments for sale for less than €300,000 and those that are available are mainly in west Dublin at significant commuting distances from the city centre.

Reynolds points to the Hines development in Cherrywood in south Dublin, one of the most high-profile schemes in the city, as a bellwether.

Based on current market values and inflation, he predicts typical two-bed apartments will probably be selling for upwards of €450,000 when they come on stream in 2018.

“These are not affordable homes.” His point is that “the private speculative build model” will not produce houses in Dublin for less than €300,000, given current land prices , construction costs and VAT.

This assertion is echoed by the Society of Chartered Surveyors Ireland (SCSI) which last year put the cost of developing a typical three-bed semi-detached house in Dublin at €330,493, which allows for a reasonable developer’s profit margin.

Windfall profits

This was €36,000 more than a couple earning a combined salary of €74,000 can afford, after having saved a deposit of €35,000.

Assuming an inflation rate of 8 per cent, the sales price will have risen to €356,000 by the middle of this year and to €385,000 by the summer of 2018.

“If the Government is going to rely on the private market for its housing needs, it has to understand how the private market works and it’s naive to expect the private sector to deliver housing at or below cost,” Reynolds says.

While demand for housing is governed by a complex set of factors, including interest rates and household formation levels, supply is led by price. That’s why construction all but dried up during the crash and four years later we have acute housing crisis and a return to high levels of inflation.

A recent report by Savills suggested that for every 10 per cent increase in a home’s sale price, land values increase by 35 per cent, a scenario which has led to land hoarding.

“Pro-cyclical Government policy has generated extraordinary windfall profits to land-owners and there is little incentive to assume development risk and build-out sites,” Reynolds says.

“Land-hoarding is a market feature. It appears to be more profitable to wait, to sell or engage in speculative planning applications than build homes,” he says.

To get the private market to increase supply the price has to inflate and this will be facilitated by inflationary measures like the Government’s new help-to-buy scheme for first-time buyers.

One way of making homes more affordable while prices are increasing is by reducing interest rates and allowing buyers take on bigger mortgages.

Drop interest rates

“If you dropped interest rates by one per cent you would straight away kick-start supply, particularly in areas where the construction costs are high,” Reynolds says.

This isn’t as forlorn an option as it seems given the State owns most of the banking sector here and interest rates are already well above the euro area average.

Ultimately the best way to square the affordability circle once and for all, Reynolds says, is for the State to step in and build affordable housing on large scale similar to projects undertaken in the early 1970s.

He cites University College Cork economist and chairman of the Fiscal Advisory Council Séamus Coffey, who has highlighted that there is no EU regulation precluding the State from borrowing to build social housing.

“The Government can go off and borrow at 1 per cent and build as much affordable housing as it wants.”

The average cost of a local authority-procured three-bed semi was recently confirmed by Minister for Housing Simon Coveney at €180,000.

“This could be rented out at less than €800 a month, significantly undercutting current market rents, at no loss to the State,” says Reynolds.

Councils also have the capacity to zone large areas of land for themselves as well as increase housing densities in certain areas. “When local authorities assume the role of developer they can provide affordable rentals and affordable housing at big market discounts,” he says.

Whether the Government has the appetite for this is another question.