The US-based Hines group has entered into a joint venture with Dutch pension investor APG Asset Management to develop and retain a substantial number of apartments and ancillary retail facilities at Cherrywood in south Dublin.

In an important breakthrough for the 400-acre Cherrywood project, Hines is to co-invest alongside APG in the joint venture that will fund both the sites and the construction of 1,221 fully serviced “build-to-rent” apartments, along with street-level shops and cafes in the new town centre. Development costs for this phase will be €450 million.

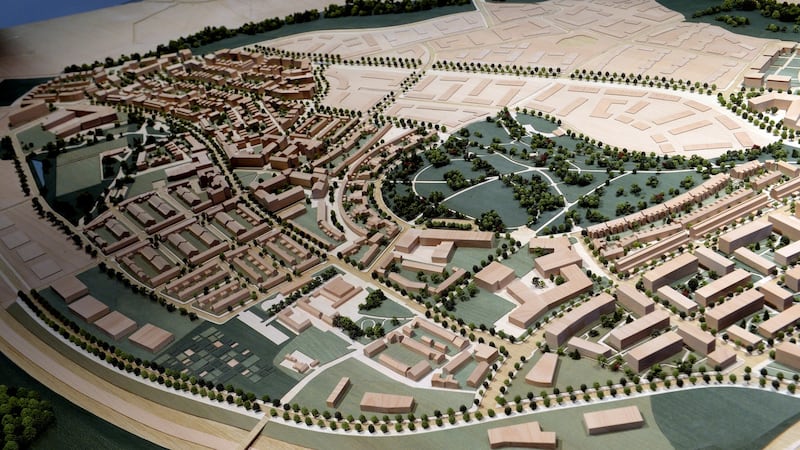

Cherrywood has been granted strategic development zoning for the planned new town in the borough of Dún Laoghaire-Rathdown. It will have more than 7,700 new homes, six schools, three parks and leisure facilities. The availability of a light rail system will help bring the planned population up to 25,000.

Brian Moran, senior managing director with Hines Ireland, described the new deal with APG as a “major endorsement” for the Cherrywood project.

Trusted partner

Moran said Hines has a strong existing relationship with APG in the development of real estate projects throughout Europe, and it was delighted to join once again with such a trusted partner in launching the first purpose-designed build-to-rent joint venture in Ireland.

Robert-Jan Foortse, head of European property investments at APG, said that having made comparable long-term residential investments in other markets such as the Netherlands, London, Madrid and Helsinki, APG was continuously looking for attractive real estate investments that helped realise stable and long-term returns for pension fund clients.

“With a focus on built-to-rent housing we are keen on making Cherrywood a core, long-term holding in our global real estate portfolio and we aim to pursue more residential-led opportunities in the Dublin market going forward.”

Wider strategy

Gary Corrigan, development director with Hines Ireland, said the new partnership framework for Hines in Ireland bodes very well for other projects to be acquired and developed as it pursues a wider strategy to build out its joint venture into a substantial private rental platform over the coming years.

Hines is a privately owned global real estate investment firm with around $100 billion of assets under management in 21 countries. It bought Cherrywood in 2014 from receivers working for the National Asset Management Agency (Nama) and a number of banks for about €280 million.

The company also owns Liffey Valley Shopping Centre, the former Central Bank on Dame Street, Bishop’s Square offices on Kevin Street, and a retail portfolio on Grafton Street.