It’s a year to the month since a group of activist shareholders in Aryzta, the Swiss-Irish baked goods group, oversaw a boardroom coup resulting in the exits of its Irish directors.

Investors that stuck around have reason to be glad the new regime vetoed the old one's instinct to sell the entire business at a precarious time to Elliott Management, US hedge fund.

Shares in Aryzta, which went on in March to scrap its Irish stock-market listing as its centre of gravity moved to Zurich, are currently trading at 1.30 Swiss francs (€1.20). That's up 330 per cent from the Covid lows of April last year – and more than 60 per cent ahead of a 0.80 francs per share takeover offer that ultimately emerged from Elliott, run by New York billionaire Paul Singer.

Tussles

Dissident shareholders, led by Swiss investor Veraison, secured backing at an extraordinary general meeting (egm) last September to parachute Urs Jordi in as chairman in one of the uglier Irish corporate tussles in recent times. Jordi was the former head of Hiestand International, which merged with Dublin-based IAWS in 2008 to create Aryzta.

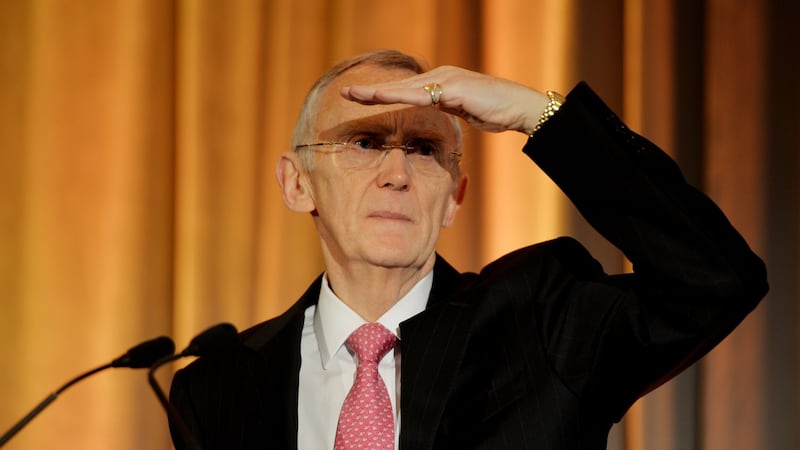

Gary McGann, the Irish business grandee who had stepped in as chairman in late 2016 to try and reboot an already deeply-troubled group, had already flagged well in advance of the egm that he was stepping down. Three other Irish directors targeted by Veraison and friends had also decided to leave on their own terms before the meeting. But the board was well advanced in its courtship of Elliot by then.

In fairness, McGann and Kevin Toland, the chief executive he hired in 2017, had already, by then, overseen almost €400 million of asset sales, deep cost cutting, and an €800 million capital raise to try repair a distressed balance sheet left by over a decade of roll-up deals by former management.

However, the group behind the Cuisine de France label here and supplier to the likes of Subway and McDonald's was nowhere near turning a corner by the time Covid-19 struck, hitting sales, particularly to catering industry.

The decision at the height of the crisis in April last year to call in investment bankers at Rothschild to carry out a “strategic review of all strategic and financial options” bore the hallmarks of a team that was running short of ideas – leading inevitably to opportunistic bid approaches from the likes of Elliott and co.

Appointment

Jordi was clear from the outset of his appointment last September that he was against a sale of the entire group and was in favour of selling unwanted assets and “streamlining” the group. Elliott was told last December where to go with its almost 800 Swiss francs a share offer for the group and Jordi has proceeded with his plan at a faster pace – and achieved more – than even some of his backers had hoped.

He started off in January by agreeing the €24 million sale of Aryzta’s remaining 4.6 per cent stake in French frozen foods group Picard, before surprising the market in March with the $850 million (€716 million) price tag achieved in a deal to sell the group’s long-troubled North American business to US private equity firm Lindsay Goldberg.

Last month, Aryzta signed up to sell its Brazilian business for an undisclosed amount to Mexican baking giant Grupo Bimbo and agreed a new €500 million revolving credit line with banks to replace a €800 million facility that was set to mature late next year.

Few are likely to be as surprised by the 90 per cent share surge so far in 2021 as Veraison head Gregor Greber, who led the charge against the old board and exited with almost indecent haste late last year.

Veraison may have raised 64 million francs in December selling almost all of the 9.8 per cent stake built up early last year for half that amount (strangely, selling at more than a 12 per cent discount to the Elliott offer that it showed no interest in supporting). But Greber clearly took this one out of the oven a bit too early.

Upside for the shares from here, however, will be more challenging, according to market observers. While underlying sales rallied by 2.6 per cent on the year in the three months to the end of May, Aryzta’s third financial quarter, they remained down more than 12 per cent for the first nine months, with catering continuing to drag even sales to retailers and quick-service restaurants improved.

Concern

A big concern that the group must address when it reports full-year results in the coming weeks is how it is dealing with rising flour, dairy ingredients and packaging costs as inflation grips economies globally as they re-open after Covid-19.

Another pressing issue is Aryzta’s €950 million of outstanding subordinated debt with no payback date – including €152 million of rolled-up interest. Jordi has acknowledged that these hybrid debt-equity instruments, where the amount owed grows every year, need to be dealt with.

There had been speculation last year that these holders of the notes would be asked to take a haircut on what they are owed to help bring down Aryzta’s debt burden.

But any hope of these fellows sharing some of the pain endured by long-standing shareholders (the stock was changing hands at almost 19 francs a piece in mid-2014) has probably evaporated.

Many of these notes were trading at 60 centimes on the franc early last year. They are all now changing hands at well above par – buoyed, like the shares, by the success of the asset sales.