Nils Wahl, one of 17 judges who lined the bench of the European Court of Justice’s (ECJ) grand chamber on Tuesday to hear the final round of the European Commission’s long legal battle over Apple’s Irish tax affairs, is known as a tough questioner.

But even some of the more seasoned court reporters monitoring proceedings from a press room in the Luxembourg complex winced as the Swedish judge took aim at the commission’s lead counsel, Paul-John Loewenthal.

The Swede appeared unconvinced by an argument that was crucial to the commission’s case: that the EU’s general court had made “legal errors” in 2020 when it ruled that the commission did not show to the “requisite legal standard” that Apple had received illegal state aid through a “sweetheart” tax deal that gave it an unfair advantage over other companies.

At one point, Wahl read out part of the ruling the commission was seeking to overturn, and suggested Loewenthal had selectively represented what the lower court had said.

RM Block

“The interpretation as you made is simply not correct,” Wahl insisted. “You say the court has identified the right test and misapplied it, but I’m telling you it says more than that.”

It will be the final chapter of the world’s biggest antitrust case, which found its way this week to the EU’s highest court

Whether the commission succeeded in convincing the judges to overturn the ruling of the lower court should become clearer in November when the court’s advocate general is to deliver his influential opinion on the case, with a ruling to follow.

It will be the final chapter of the world’s biggest antitrust case, which found its way this week to the EU’s highest court, almost a decade after the commission started investigating how the iPhone maker pays tax in the Republic, home to its main subsidiaries outside the US.

At stake is more than €13 billion that sits in an escrow holding account: the back taxes, plus interest, that the EU competition commissioner Margrethe Vestager ordered Apple to pay to Ireland in August 2016.

Last-ditch effort

Vestager’s last-ditch effort to quash the 2020 ruling follows legal setbacks in the former Danish politician’s pursuit of other high-profile tax cases involving multinationals, including Fiat Chrysler and Amazon units in Luxembourg and Starbucks in the Netherlands. It is likely to fail here, too, according to lawyers and tax experts.

“Failure to overturn the general court’s 2020 ruling in favour of Apple [and Ireland] will be a blow to commissioner Vestager’s legacy,” says Ronan Dunne, partner and head of the EU, competition and state aid group at law firm Philip Lee in Dublin, noting how the commission had taken a novel approach in each of the cases by using state-aid rules to tackle what it perceived as “aggressive tax practices” in certain member states.

“Her reign started with a bang, but there have been a series of defeats in the courts in relation to the commission’s state aid determinations regarding tax-related matters during her tenure. The decision-making practice of the European courts to date suggests they strongly disagree with the commission, undoubtedly undermining any attempts to use state aid rules in this manner moving forward.”

[ Apple argues disputed €13.1 billion is being paid in tax to the United StatesOpens in new window ]

Nonetheless, the spotlight she has shone on tax planning by major companies has helped drive regime changes both in Ireland and globally in the past decade, which have in recent times turbocharged Irish corporate tax receipts, according to analysts. As a result, Apple, which moved intellectual property (IP) to the Republic in 2015, is now believed to be among the main contributors, as tax credits associated with that transfer have largely been used up.

The Apple investigation turned formal in June 2014, when the commission made an initial finding that Apple’s Irish tax arrangements were improperly designed to give it a financial boost in exchange for jobs

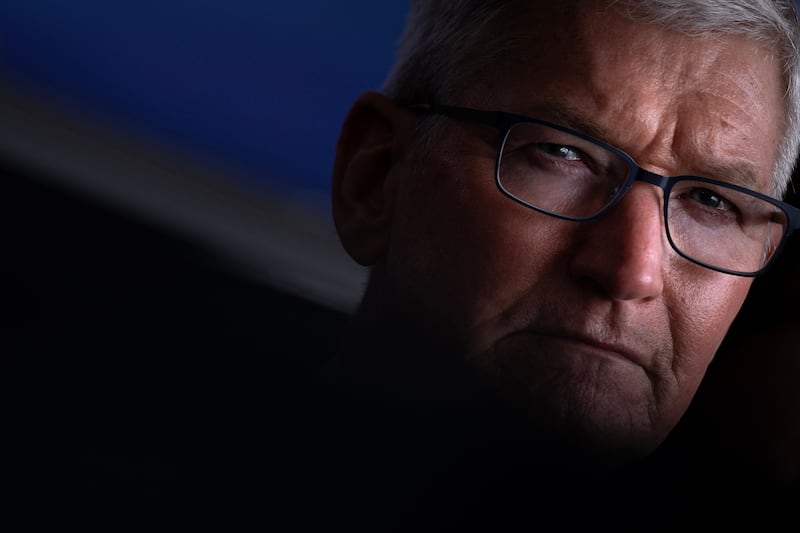

The commission’s interest in Apple’s Irish tax practices began this month 10 years ago, when Apple chief executive Tim Cook told a US senate committee inquiry that the company had had a “tax incentive arrangement” in the Republic from when it set up a manufacturing facility in Cork in 1980. This had resulted in two Irish based subsidiaries, Apple Sales International (ASI) and Apple Operations Europe (AOE), paying a top rate of 2 per cent on profits in the three years before the hearing in Washington DC, he said.

The Republic’s headline corporate tax rates has stood at 12.5 per cent for the past two decades.

Cook’s comments prompted immediate denials from the Government that Apple had cut special deals with Revenue. Within a week, he had also backtracked, saying the company did not use “tax gimmicks”. But by then, Brussels was asking awkward questions. It would go on to ask member states for details of about 1,000 other tax “rulings” by domestic authorities, resulting in the likes of Starbucks and Amazon also cropping up on its radar.

The Apple investigation turned formal in June 2014, when the commission made an initial finding that Apple’s Irish tax arrangements were improperly designed to give it a financial boost in exchange for jobs.

Unfair advantage

Its final decision, in August 2016, put the tax Apple owed to Ireland at €13.1 billion, plus interest, bringing the total to about €14.3 billion.

The decision centred on two tax opinions – or “rulings” as they are referred to – handed out by Revenue, in 1991 and 2007, the year the first iPhone was unveiled and Apple’s profits started to balloon.

The main thrust of the commission’s case was that the rulings gave the US technology giant an unfair and select advantage over other corporate taxpayers, as it allowed the group to channel most European sales through employee-less “head office” parts of ASI and AOE in Cork, which were non-resident for tax purposes. Only the activities of Irish “branches” within the same units were subject to tax in the State.

[ Explainer: why is the Apple tax case hearing important?Opens in new window ]

ASI was responsible for the sales and distribution of iPhones and other products outside of the US, while AOE had a role in manufacturing and assembly. Both fell under the umbrella of an Irish holding company, called Apple Operations International (AOI), which sits over most of Apple’s subsidiaries outside the US.

The commission’s view was that valuable intellectual property (IP) behind Apple products lay inside the Irish branches of ASI and AOE, meaning that most of the profits were taxable by Revenue in Dublin. Apple, on the other hand, argued it was held outside the branches – and ultimately controlled from group headquarters, in Cupertino, California.

The burden of proof in the general court case, however, lay with the commission. That court’s ruling in July 2020 was clear. “The commission has not succeeded in showing that ... the Apple Group’s IP licences should have been allocated to those Irish branches when determining the annual chargeable profits of ASI and AOE in Ireland,” it said.

In the ECJ this week, lawyers for the commission argued that the general court had made “legal errors” almost three years ago, by confusing aspects of Apple’s corporate structure.

However, senior counsel for Apple, Daniel Beard, told the court that Apple has been paying €20 billion in tax to the US on the same profits in the decade to 2014 that the commission argues was owed to the Irish exchequer.

‘Victory for Ireland’

Former Irish attorney general Paul Gallagher, who led the Irish team, said the commission’s analysis was “infected” by the wrong legal premise and that the State “applied its tax rate to those profits which it was entitled to tax”.

“In the likely event that the ECJ upholds the general court ruling in favour of Ireland and Apple, this would represent a victory for Ireland and reflect positively on the transparency of our tax regime,” says Peter Vale, a tax partner with Grant Thornton Ireland.

While the exchequer would stand to benefit to the tune of more than €13 billion from the commission succeeding in its appeal, “this could potentially seen as a negative result” in terms of the State’s foreign-direct investment (FDI) offering, even though “our regime has undergone significant reform over the last ten years”, he says.

Kevin Mangan, tax partner at law firm Mason Hayes & Curran, also says that the commission will have difficulty succeeding in its appeal.

“The use of state aid rules – traditionally the strongest tool available to the commission – to police and pursue perceived multinational tax avoidance was a key pillar of the commission’s strategy under Vestager,” he said.

The strategy has run into trouble before EU courts. The ECJ moved last November to overturn an earlier general court ruling that the commission had been correct in ordering Fiat Chrysler in 2017 to pay Luxembourg €30 million in back taxes.

A decision by the commission in 2015 that coffee chain Starbucks should pay the Netherlands up to €30 million of taxes was also overturned by the lower EU court in 2019. Vestager’s officials decided against appealing that decision.

In May 2021, the general court overruled a commission finding that Luxembourg had granted €250 million of illegal tax benefits to Amazon. The commission subsequently appealed that decision to the ECJ, with an advocate general opinion on the matter set to be delivered next month.

Closing loophole

“However, one could argue that these cases, while not entirely successful, have helped drive tax to the top of the political agenda and unified member states on tax transparency and combating international tax avoidance, a point which is borne out by a range of anti-avoidance and information-sharing measures which have been adopted by the EU in recent years,” said Mangan.

Within months of the US Senate hearings, then minister for finance Michael Noonan announced that he was closing the loophole that had been used by Apple – and others – that allowed a company to be incorporated in the Republic but be “stateless” in terms of tax residency.

“We know that Irish corporate tax law came under scrutiny in a number of inquiries quite recently and we don’t want to incur any reputational damage,” Noonan said at the time.

By the end of 2014, Apple had registered AOI, its Irish umbrella company, and ASI in Jersey for tax purposes, while AOE had become tax-resident in the Republic, according to information in documents, known as the Paradise Papers that were leaked in late 2017.

Of much greater significance was a move by Apple in 2015 to relocate intellectual property (IP) to the Republic by way of an intragroup acquisition carried out an Irish-resident subsidiary of AOI.

Detailed analysis by Seamus Coffey, an economics lecturer at University College Cork and former chairman of the Irish Fiscal Advisory Council, in his Economic Incentives blog suggests that purchase cost about $240 billion (€222 billion). It was a deal that threw Irish trade, balance of payments, investment and, ultimately, gross domestic product (GDP) figures out of kilter. Irish GDP soared by 26 per cent that year, leading US economist Paul Krugman to coin the phrase “leprechaun economics”.

The purchase allowed the unit to claim tax deductions through capital allowances. Coffey estimates, extrapolating figures in AOI financial statements that have been publicly available since 2016, that capital allowances – or deferred tax assets – started off at $30 billion in 2015. But they subsequently dwindled to $812 million by last September, according to AOI’s latest annual accounts, filed with the Companies Registration Office (CRO) last month.

Coffey estimates that Apple was behind an unusual spike in corporate tax receipts in both March 2022 and 2023 and last August, based on its unusual financial year-end and the fact that Irish companies make preliminary corporate tax payments in months six and 11 of their annual fiscal periods.

Political drive

Apple likely decided to move IP to Ireland as a result of the commission’s state aid investigation, according to Coffey.

A host of other US multinationals subsequently moved IP to the State in and around 2019 on foot of changes to guidelines from the Organisation for Economic Co-operation and Development (OECD) on the pricing of transactions between two parts of the same group (known as transfer pricing) and changes to the US tax regime.

“At one point, it was suspected that Ireland may be vulnerable to changes that were going to take place. As it turned out, it became a major beneficiary to the changes

— Dermot O'Leary, economist at stockbroker Goodbody

Eye-watering headlines in the past decade on the EU’s claims about Apple’s Irish tax liabilities have fuelled an international political drive to clamp down on tax avoidance practices by large multinationals.

“At one point, it was suspected that Ireland may be vulnerable to changes that were going to take place. As it turned out, it became a major beneficiary to the changes, as large companies move their tax residencies and IP from zero-tax jurisdictions to legitimate, yet low-tax, jurisdictions,” says Dermot O’Leary, an economist with stockbroker Goodbody.

The Government estimates that windfall corporation tax receipts will rise from €11 billion in 2022 to €12 billion this year and average that level over the subsequent three years.

The €13 billion involved in the Apple case “now pales into insignificance relative to the recurring windfalls that Ireland has received over recent years and is in forecasts for the coming from years”, O’Leary says.

All else being equal, Ireland’s commitment to introduce a 15 per cent minimum tax next year for large companies (those with turnover in excess of €750 million), as part of an OECD-led global tax deal should increase its tax take from Apple, says Coffey. However, it is more difficult to assess the impact of another planned OECD initiative, aimed at making large multinationals pay more tax in major markets where they sell and less in headquarter countries, he says.

“The last 10 years has seen huge upheaval in the global tax landscape, originally driven by public sentiment and sustained by political momentum for change,” says Vale. “In some ways, the Apple case now feels like it’s from a previous era, things have moved on so much.”

*This article was updated on Friday, May 26 to correct attribution of statement and quote in paragraphs 28, 29 and 33.