Gas prices are falling on European markets as demand for the fuel eases, so why are homes and businesses still facing high energy bills?

Because suppliers buy the gas used to generate your electricity, or that you use for heating and cooking, on a different market to one where prices are falling.

What does that mean?

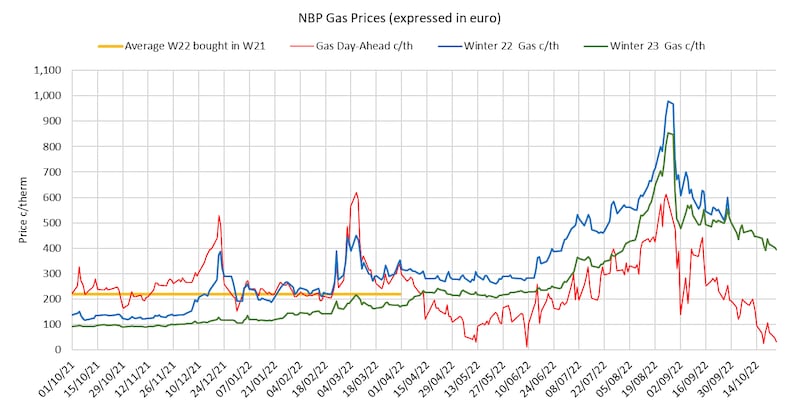

The reports you are seeing about falling gas prices cover what is called the “spot” market, which is where companies and traders buy gas for delivery the next day. This is the shortest-term, and so the most volatile, of all markets and provides little of the fuel used to provide energy to homes and businesses.

Where does the gas we use come from?

Most energy companies buy the gas used to generate electricity, or the gas they sell to homes and businesses, up to a year in advance on what are called “forward” markets, where prices differ and are less volatile, even though they do reflect overall supply and demand.

Calm after the storm for UK markets / Used-car prices on the rise

Does that mean we are paying for gas bought a year ago?

In short, yes. Household electricity and gas prices reflect what suppliers agreed to pay a year ago for fuel that is now being delivered to them.

RM Block

How different are those markets?

Spot market prices were up to 15 times what they were in early 2021, before all this started, at one point in August, but domestic energy costs increased 2.5 times over the same period.

So is the spot price lower or higher than the forward price?

These things move constantly according to demand. But, as an example, early this week, spot prices in London, where Ireland buys much of its gas, were around 33 cent a therm (one of the units in which it is sold), but they were 394 cent for next winter on the forward market.

[ Energy prices likely to rise further despite falls in gas priceOpens in new window ]

Could the two markets begin reflecting each other more?

That is harder to predict as the spot market trend could still be very short term so may not end up feeding through to forward markets.

Why are spot prices falling so rapidly?

There are a few reasons but it is mainly because:

- European gas stores are almost full, partly thanks to high liquefied natural gas (LNG) imports

- Demand is low as the autumn so far has been mild generally while consumers and businesses have reined in energy use

- The EU is considering a common buying policy to cut out inflationary competition between member states

- China’s gas consumption has been lower than usual as it continues with Covid lockdowns.

What could send the market rising?

Any number of variables, including Russia cutting off the remaining pipeline supplying gas to Europe, a cold snap in the coming months or China stepping up demand, increasing prices once again.

We’re not out of the woods then?

Far from it, the energy industry is already worried about next winter while many analysts believe this crisis will last into 2024 at least.