Inflation complicates a lot of things – including the budget. While politicians promise tax “cuts” and increases in welfare and pensions, in reality a lot of the budget day changes are needed to adjust for inflation. Significant moves are required just to ensure that those reliant on State payments do not suffer a fall in their real – or inflation-adjusted – income. The Government also needs to make sure taxpayers do not see an increase in the proportion of their income going in tax.

This is straightforward enough to understand for those on welfare. If prices rise by, say, 5 per cent and welfare rates go up by 3 per cent, then those relying on such payments are worse off. It is a bit more complicated for income taxes, but still important. Unless tax credits and tax bands are adjusted for inflation, taxpayers can end up paying a higher proportion of their income in tax. The real, or inflation-adjusted, value of tax credits and allowances falls if they are not increased in tandem with prices. And taxpayers enter the higher 40 per cent income tax rate, or pay more of their income at that rate, if the entry point is not increased. Currently, this entry point to the higher rate – also called the standard rate cut-off point – is €40,000 for a single person and €49,000 for a one-income couple. In this way, what economists call “fiscal drag” acts as a silent tax increase.

Without fully indexing the income tax system, those paying tax can find the gains from wage increases partly eaten away. When you then count in inflation, they can suffer a fall in real living standards. How far governments should go to combat this is a policy question. But traditionally Irish governments have trumpeted any change as a “tax cut” even if in many cases it is only dealing with this inflation factor.

1. The big costs of indexation

The Irish Fiscal Advisory Council (IFAC) in its latest budgetary assessment report this week, estimated that the cost of indexing the income tax system would be €1.33 billion for 2024. On its calculations, the Department of Finance, in its recent budget estimates, has pencilled in €500 million in tax reductions, but has left other money unallocated that could increase this. Political negotiations look certain to increase the tax cut package – perhaps to around €1.6 billion. But the point is that the vast bulk of this money would be compensating for higher inflation, rather than cutting the actual level of taxes people pay.

RM Block

The Department of Finance has not traditionally favoured automatic indexation of the income tax system, preferring to keep the flexibility of allocating cash each year. And for politicians, this allows for the unveiling of tax “relief” each year. This does mean taxpayers would pay less than if there was no change, but the overall burden of taxes on income does not fall.

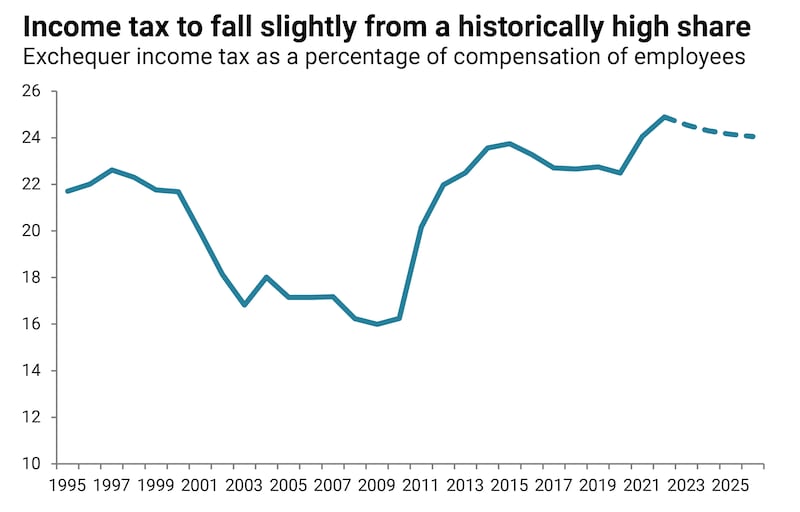

The story of the income tax burden has been of a sharp fall as taxes were cut in the run up the financial crash and then a big reversal thereafter as taxes on income were hiked, including the introduction of the USC. The burden in recent years has exceeded that in place before the pre-crash tax cuts and is now stabilising. When the impact of inflation is counted in, it would take significant moves to reduce the income tax burden in a noticeable way – and the huge additional bills faced by the exchequer in the years ahead have led bodies such as the Fiscal Advisory Council and the Commission on Tax and Welfare to warn that overall taxes will have to rise in the years ahead, rather than fall, despite the current strong surpluses.

[ Sign up for On the Money, our weekly personal finance newsletterOpens in new window ]

2. What this means for living standards

Analysis by the ESRI, presented by senior research officer Dr Karina Doorley to the Oireachtas Committee on Budgetary Oversight last October looks at the institute’s research on last year’s budget. Counting in the once-off measures, the impact of the budget tax and spending package was to leave households, on average, slightly better off after inflation – by around 0.75 per cent of disposable income. How people actually fared is also influenced, of course, by how their wages, their job and other factors changed. While, on average, households were better off, this did not apply in all cases given the impact of inflation on some.

However, the ESRI analysis of permanent budget measures – ignoring the once-off giveaways – showed that households are worse off compared to a situation in which tax and welfare had been fully indexed for inflation going back to 2020. The permanent budget changes in Budget 2023 – specifically the extension of the standard rate income tax band – benefited higher income households the most and so the bigger losses were for lower income households. The Government would argue that these households were protected by temporary measures. The obvious question then is whether there will be more temporary measures this year.

An analysis of the last budget by the Parliamentary Budget Office came to a similar conclusion. Looking at income tax and USC changes it showed nominal, or before inflation, gains for all income groups paying tax between 2021 and 2023 (taking into account minimum wage rises) However, taking account of inflation, the real take-home pay of taxpayers decreased, on average, across the board. It is debatable to what extent the Government should compensate people for higher inflation. But there is a case to at least index welfare payments and the income tax system to inflation.

Of 38 OECD countries covered in a recent survey, 17 indexed the personal income tax system automatically each year, generally for inflation, while 21 did not. A small majority indexed welfare benefits. The OECD says that over the last few years, many workers have received a “double blow”, as inflation drives real wages down but pushes up the take from tax on work. The current Irish programme for government promises to index income tax credits and bands for inflation each year from 2022 on, though no automatic adjustment system has been put in place. A consultation process currently underway by the Department of Finance on personal tax will cover this indexation issue, though what, if any, policy action will follow is unclear.

3. The overall picture

The budget picture, as presented by IFAC, offers a good deal less room for manoeuvre than that implied by the public and political debate now underway. This is for two reasons. First, IFAC argues that the Government should reimpose its own spending rule, limiting the expenditure rise to 5 per cent. Second, it calculates that the Department of Finance has not yet counted in the full cost of maintaining existing services and dealing with issues such as the arrival of refugees. Accounting for this, it says the Government will have to choose between spending increases and tax cuts – and may have to seek extra tax revenues elsewhere if it wants to go beyond modest measures. We will have to wait until the Government’s economic statement to see how it approaches the 5 per cent rule for next year (it was set aside during Covid and also last year) and the proposed balance between permanent and once-off measures. But IFAC’s analysis has provided something of a reality check as the budget demands build up.