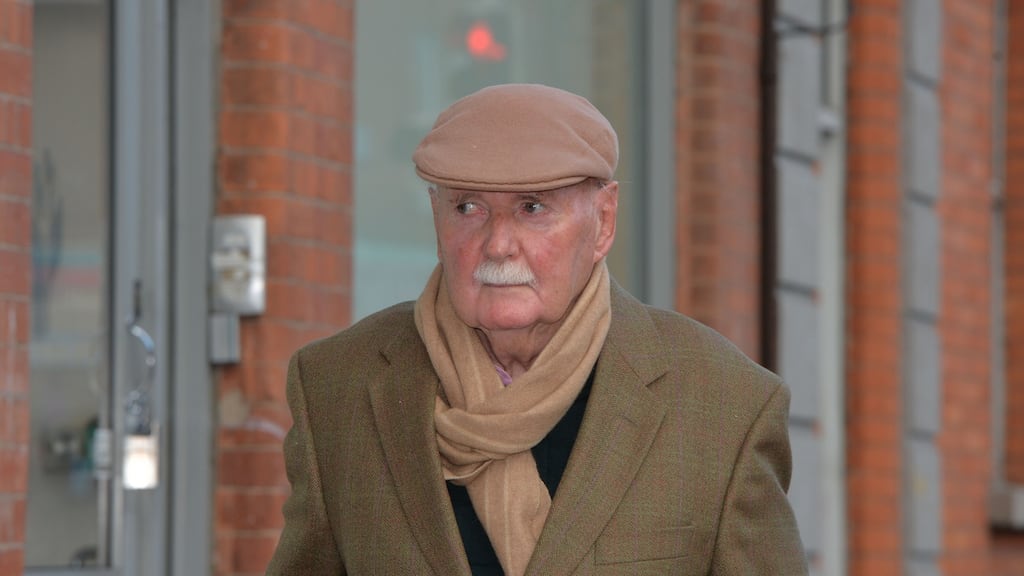

Former Irish Nationwide Building Society chief executive Michael Fingleton has lost his appeal arguing he cannot lawfully be subject to a Central Bank inquiry into alleged regulatory breaches at the Society.

The three-judge Court of Appeal today dismissed all grounds of Mr Fingleton's appeal against the High Court's rejection of his challenge concerning the inquiry.

Ms Justice Mary Finlay Geoghegan and Ms Justice Mary Irvine gave separate judgments dealing with different grounds of appeal and dismissed all those grounds, including claims of objective bias on the part of the Central Bank, that it lacked jurisdiction or had delayed.

The judges also rejected claims his entitlement to a fair hearing was prejudiced by the Central Bank’s publication of details of a settlement agreed with the society itself over the bank’s inquiry.

Mr Justice Michael Peart agreed with his colleagues.

Mr Fingleton, now aged in his late seventies, was not in court for the delivery of the judgment.

His core argument in his appeal was that he had retired before the inquiry was formally initiated in 2015 and the relevant law does not allow for inquiry into his “past” conduct of the society’s affairs. Lawyers for the Central Bank had rejected that argument as “nonsense”.

Collapse

The Central Bank estimates the collapse of INBS, which was nationalised and merged with the former Anglo Irish Bank in 2011, has cost the Irish public some €5.4 billion. That figure is disputed by Mr Fingleton, who joined INBS in 1971 and retired as chief executive in 2009.

The inquiry was initiated into allegations that certain prescribed contraventions were committed by both INBS, and certain persons “concerned with” its management, between August 2004 and September 2008. If the allegations are upheld, the relevant law allows for imposition of sanctions of up to €5million on a regulated firm and up to €500,000 on individuals.

The Central Bank previously announced it had reached a settlement with INBS’s then management concerning the allegations against the society.It said the settlement involved INBS admitting multiple breaches of financial services law and regulations. The maximum €5million fine was imposed, but the Central Bank said that would not be collected as INBS had no assets.

Mr Fingleton and several other former officials of INBS remain subject of the inquiry.

In his High Court judgment dismissing Mr Fingleton’s case, Mr Justice Seamus Noonan ruled a person who by virtue of their status was in a position to influence the actions of a regulated entity may be subject to Central Bank investigation even if they no longer held that position. He also found Mr Fingleton had failed to show any inherent unfairness in the inquiry process.