There are no easy targets. That is the difficulty for the Minister for Finance, Paschal Donohoe, as he tries to shape the October budget. As shown by this week's exchequer returns, there won't be a pile of spare cash this year to help make things a bit easier. The Fiscal Advisory Council warned, meanwhile, that the Government needed to mind its money, as it was better to have a few euro to spare in case Brexit turned nasty.

So any meaningful new measures will have to be paid for by cash raised – or saved – elsewhere. But where?

The dilemma is highlighted by the debate over a plan in the programme for government to restrict tax credits for higher earners. On the face of it this could be “sold” politically, raising a bit more, probably from those earning more than €100,000, with the money used to fund general tax reductions or new spending.

If the phasing out of credits started at the €100,000 income level, then initial estimates from the Department of Finance were that it could raise more than €200 million. However, recently-published official papers from the Tax Strategy Group – government officials who meet to scope out the budget possibilities – said the final figure could be "significantly higher". Either way, in a budget where less than €500 million in additional cash is likely to be available, this would be a significant amount.

Gradual withdrawal

But it is not an open goal. What is at play here is the proposed gradual withdrawal of the benefit of the €1,650 PAYE tax credit from higher earners. How would it work? One option floated by the Tax Strategy Group was to withdraw the credit gradually at income levels between €100,000 and €120,000.

Remember that a tax credit is just cash that you get off your tax bill. So under this plan, as earnings rose over €100,000, this cash benefit would gradually be withdrawn. Phasing in the restriction of the credit in this way would mean that for every €1,000 in additional income over €100,000, taxpayers would lose €82.50 of the credit. By the time earnings get to €120,000, the benefit of the credit would be completely gone.

Ensuring fairness would be tricky. As the Tax Strategy Group pointed out, there would be particular questions about how this would apply to jointly-assessed couples and how to maintain fairness between them and two-income couples, a point which has been controversial in the past. And if you wanted to get more tax from the better off, there are undoubtedly easier ways to do it. This route would, as the London-based Institute for Fiscal Studies said in a pre-budget submission, “further complicate what is already a remarkably convoluted tax schedule”.

It would also mean that on incomes between €100,000 and €120,000 the marginal tax rate – the tax take on each euro of extra income – would be more than 60 per cent. After €120,000 it would then revert back down to 52 per cent. This would lead to some weird swings in the incentive to earn extra income for those affected.

Raising more income tax from this group would also add to the current reliance for a large chunk of income tax on a small group of people. The Tax Strategy Group papers point out that the 6 per cent of taxpayers earning more than €100,000 – about 150,000 single people and jointly-assessed couples – pay just under half of all income tax and universal social charge. Compared with other countries, our tax on lower earners is relatively light and on higher earners relatively heavy. Given the high cost of living here, lower earners need the cash. But putting more income tax on to higher earners could also affect competitiveness and the drive to attract foreign direct investment.

Economic theory would suggest looking elsewhere for more tax revenue. The problem for the Government is that raising taxes or charges in other areas is even more controversial – and in the aftermath of the water charge mess will not generate the kind of political support needed.

Property tax

The Government has to decide what to do with the residential property tax from 2019 on, but there is already a threatened uprising in Dublin if the tax is based on fast-inflating market values. There appears to be little political support for developing a stable residential property tax.

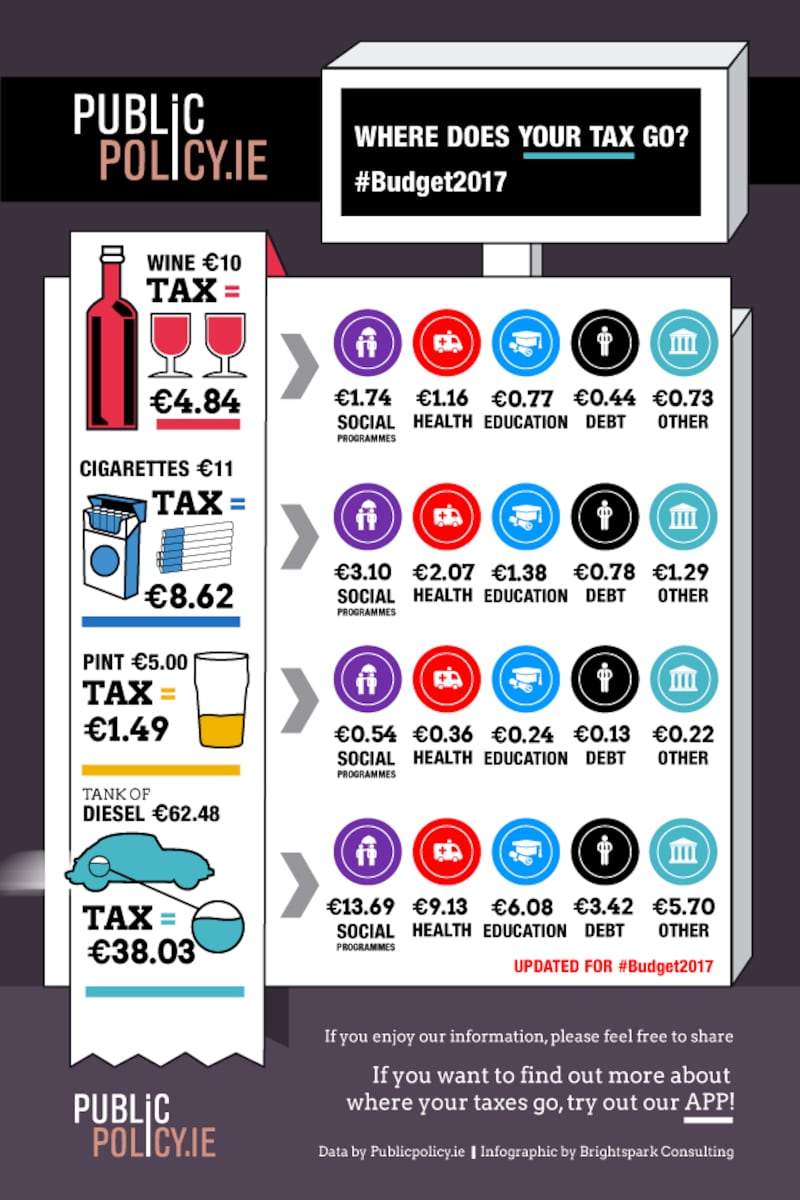

There will be more money from excises. A new tax on sugary drinks is due in March 2018, though fears of smuggling and moves by manufacturers to make drinks less “sugary” and avoid the tax mean the yield is likely to be modest. Tax on diesel may increase to bring it closer to petrol – given the updated environmental evidence – though the transport lobby will protest. And while a big increase on tobacco is a racing certainty, recent evidence suggests that buying behaviour may be being affected by high tax levels.

In short, there are no easy ways to raise fresh cash. In the current political set-up, where the Government relies for support on the Independents and Fianna Fáil, this points towards a modest enough package. Tobacco hikes and a few other tweaks will raise a bit more in tax, allowing some modest reductions. The PAYE credit debate will be interesting to watch.

There may be promises of more to come in future years in tax cuts, but taxpayers won't be booking a holiday or changing their car on the strength of Budget 2018. The money just isn't there.