It’s home to some 75,000 people – bigger than Waterford or Limerick cities – and yet there are just three properties currently available for rent in the area on property portal Daft.ie.

Blanchardstown, in Dublin 15, is experiencing an exceptionally tight squeeze on rental properties, on the back of continued population growth, landlords leaving the business, and Airbnb attracting some landlords into the short-term rental market.

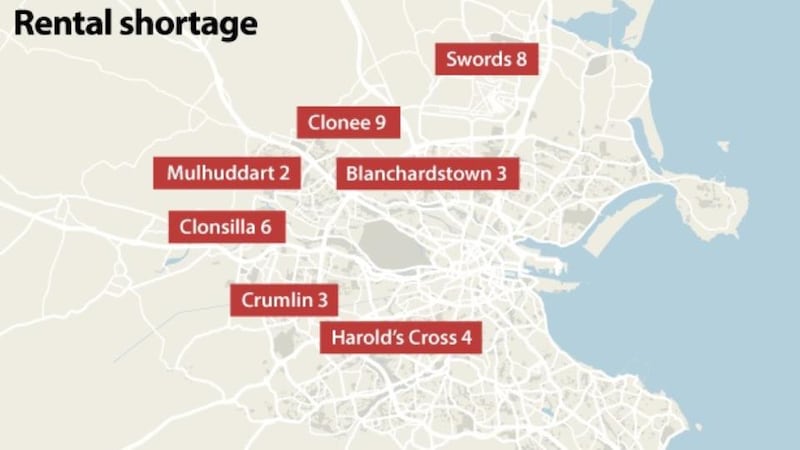

It’s a crunch also affecting the wider area; in nearby Clonsilla, itself home to thousands of new homes as the city sprawled west, supply is also constrained, with just six properties available for rent. Clonee has nine properties while Mulhuddart has just two properties for rent, although nearby Castleknock fares better, with some 17 properties on the rental market – albeit at higher rents.

This shortage of properties is pushing up rents – even if they are now limited by new rules. In the year to December 2016, rents in Dublin 15 rose by about 15 per cent, while a two-bed apartment is now listing for €1,450 on daft.ie, and a three-bed duplex townhouse is available for €1,800 a month. A three-bed apartment in Clonsilla will set you back €1,650 in this area, or as much as €2,200 for a four-bed.

Local agent Patrick Molloy of Molloy Estates agrees that there is a “severe shortage” of properties for rent.

“You can’t get properties into rent. There is no supply coming on the market,” he says, adding, “I’ve never seen it as bad”.

Crowds at viewing

On Saturday, Mr Molloy was instructed to rent a property in Clonee; by today, the property had 580 hits on his website, and Mr Molloy expects 20-30 interested parties to show up at the viewing on Tuesday evening.

Of these, the landlord will select just one to rent the property; the others will have to keep on searching in an ever-tightening market.

“It’s a disaster for people,” says Molloy.

While rental constraints are in evidence right across the capital, the shortage appears particularly keen in the area. The most recent census showed that population growth in the wider Fingal area expanded by 8.1 per cent since 2011, while three of the top-10 fastest-growing electoral districts in the country are located in the Dublin 15 area. Back in 2011, Blanchardstown and its immediate surroundings had a population of almost 70,000.

The area is also home to a third-level institution, Blanchardstown Institute of Technology, as well as a number of multinational employers, including Xerox, Paypal and Symantec, and saw considerable housing development in the years up to the property crash. However, the supply of properties in the region has plummeted in recent times.

North Dublin

It’s a similar story if you follow the M50 northwards to the airport. Swords, north Dublin, was home to some 46,000 people at the time of the last census – but the area has just eight properties for rent at present, just two of which are houses.

And it’s not just the north and west of the city that are struggling with supply; in Crumlin, Daft.ie is advertising just three properties for rent, four in nearby Harold’s Cross.

This is in stark contrast to areas like Sandyford or Ballsbridge in south Dublin,where apartments are in plentiful supply and where Daft.ie currently has 40 and 90 listings, respectively. The crunch in Dublin also contrasts with a better supply of properties across the country. In Limerick city, which has a population of about 58,319, there are 68 properties for rent; Cork city (population 125,622) has 191 properties for rent; while Waterford city (population 48,369) has 93 properties for rent.

One of the factors that could be behind the shortage in particular parts of the capital is Airbnb. It lists 30 properties available for short-term let in the Blanchardstown area, while in Swords, the figure is as high as 87.

“Landlords are getting double the rent by going the Airbnb route,” says Molloy, adding that another issue is the current tax treatment of landlords, whereby as much as 50 per cent of profits made go to the Revenue – and the other half goes to pay the mortgage.

“It’s not financially viable,” says Molloy, adding that “a serious tax incentive” is needed to keep landlords in the business, and attract “fresh blood”.