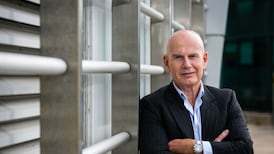

Mark Paul

Albert Manifold, chief executive of building materials giant CRH which reported strong growth on Thursday, says the company could take a decade to return to its pre-crash performance levels.

CRH on Thursday announced sales of almost €19 billion for 2014, up 5 per cent, as well as a €1 billion turnaround in its pretax profits to €761 million, up from a loss in 2013 of €215 million.

The improved performance was driven by growth in its main markets, such as the US and Britain, and growing margins across its six operating divisions. Performance at its Irish division also improved.

Mr Manifold said CRH’s return on net assets, while growing, was still well below historical levels and would take up to a decade from the crash to restore.

“I think this is longer than a normal cycle, which would be seven years. This is more like a ten-year recovery, so it will be 2018 or 2019 before we are back to where we want to be. Europe is only really starting to recover,” he said.

CRH recently agreed a €6.5 billion deal to acquire certain assets of its rivals, Lafarge and Holcim, who are merging. CRH has also been selling off some of its underperforming assets as it realigns its business to chase higher returns.

Maeve Carton, the company's chief financial officer, said it had agreed "close to €1 billion" of disposals in 2014, including deals that are yet to close.

The company has previously indicated that it would sell off between €1.5 billion and €2 billion of assets over a period of up to three years.

“We are well on the way to that,” said Ms Carton. “We are working under the radar [on more transactions].”

Mr Manifold said CRH was “ disposing of assets at 11 times earnings, and buying new assets at 7 or 8 times earnings”.

“That’s good business any day of the week,” he said.

Aside from the Lafarge-Holcim acquisition, Ms Carton insisted the company had a strong pipeline of “normal” acquisitions it is working on. “We have a really clear idea of which acquisitions we want to target,” she said.

Mr Manifold said the portfolio review process that is driving its disposals strategy may be adjusted, particularly in Europe, depending upon the impact of assets it is picking up from the Lafarge-Holcom deal.

“It could cause us to go back and look again at some regions,” he said.

CRH’s cost reduction plan delivered savings of €118 million, ahead of a €100 million target.

The company reported sales growth of 4 per cent and 7 per cent at its European “heavyside” and “lightside” divisions respectively, although profits growth was much higher as a result of cost control. Its European distribution division also grew, but not as strongly.

It also reported strong profit growth across its American divisions, driven by the improving economy and construction sectors there.

The company also confirmed it has no plans to end its listing on the Dublin stock exchange, although its primary listing is in London.