Asking prices for homes accelerated again in the first quarter of 2024 as the number of properties listed for sale slumped to a new low, according to Daft.ie.

In its latest housing market report, the property website said house prices rose by an average of 1.8 per cent in the first three months of the year having fallen by 1.3 per cent in the previous quarter.

The typical listed price for a property on its website was €326,469 which was 5.8 per cent higher than a year earlier and 30 per cent higher than at the onset of the pandemic.

The company linked the latest price trend to the overall shortage of properties available to buy particularly in the second-hand segment of the market and the recent relaxation of the Central Bank’s mortgage lending rules.

Gerry Thornley: IRFU decision on Sevens reflects the cold, hard business of sport

Cannes 2025: Tom Cruise’s death-defying wing-walking, and the festival’s ban on an actor accused of assault

Out of the house and into a summer job: What are your teenagers’ rights

Irish history takes off on TikTok: Meet the people teaching the world about Ireland in 60-second bites

It noted that the number of homes available to buy on its website as of March 1st was below 10,500, an all-time low for the series which extends back to January 2007.

It also highlighted that the number of homes available to buy currently was just 40 per cent of the pre-pandemic 2019 average.

“The new low in homes available to buy is driven by the second-hand segment and highlights the very tight conditions in the second-hand market across the country since Covid-19,” Daft report author and Trinity College Dublin economist Ronan Lyons said.

“The number of homes being built has risen steadily. But interest rate increases have affected the recovery of the second-hand market. As interest rates peak and then fall, and in particular as sitting homeowners roll off fixed-rate mortgages, there should be an improvement in second-hand supply,” he said.

“Nonetheless, availability is well below half the levels seen pre-Covid-19, meaning it may take years for second-hand supply to recover to normal levels,” he said.

Mr Lyons also singled out the Central Bank’s relaxation of the mortgage rules as a factor driving the latest price increases.

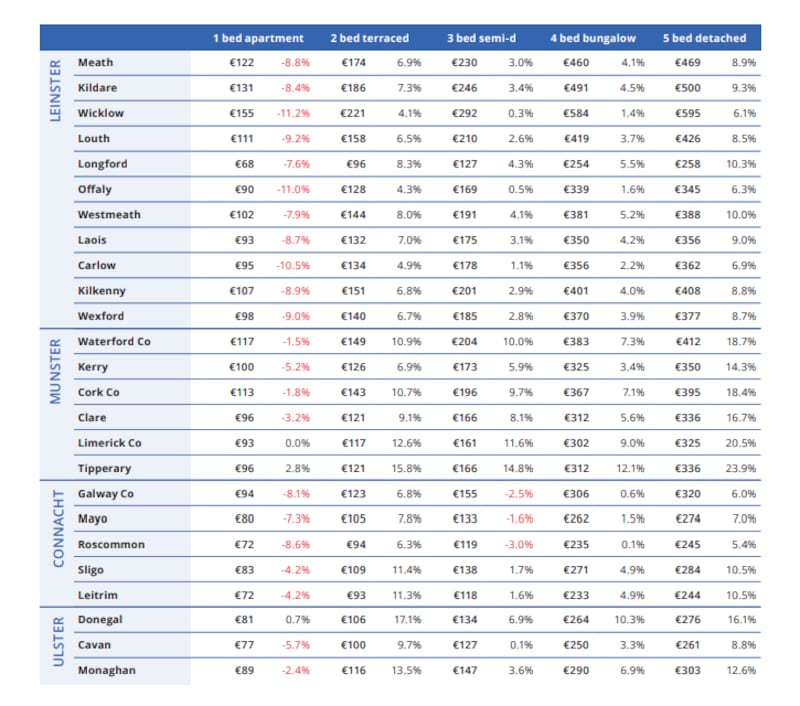

“It is a feature – not quite a bug but certainly not an intended result – of the Central Bank’s mortgage rules that they shift housing demand out of more expensive areas like Dublin and, effectively, down the motorway network,” he said.

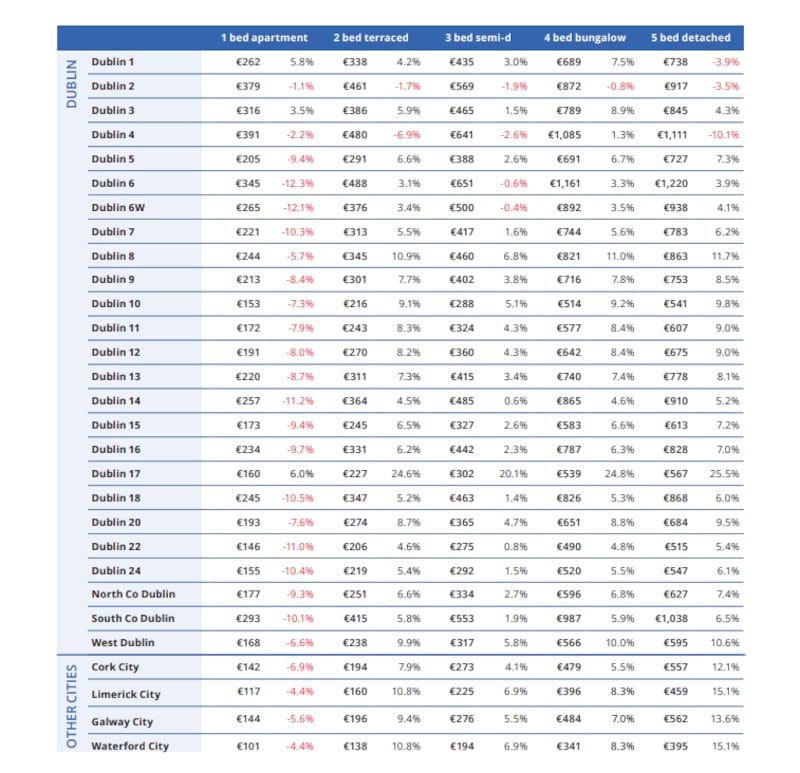

The Daft report indicated that the average list price for a property in Dublin city in the first quarter was €437,125, up 3.2 per cent year on year. This was followed by Galway city (€378,504, up 9.4 per cent); Cork city (€347,409, up 7.3 per cent); Limerick city (€274,427, up 10.3 per cent) and Waterford city (€247,064, up 10.2 per cent).

The analysis also produced what Daft described as a measure of “market heat”, the premium paid by buyers above the listed price. The typical transaction price in the first quarter of 2024 was 4 per cent above the listed price compared to 1.3 per cent a year previously.

- Sign up for Business push alerts and have the best news, analysis and comment delivered directly to your phone

- Find The Irish Times on WhatsApp and stay up to date

- Our Inside Business podcast is published weekly – Find the latest episode here